The article provides insight into the current state of the market trend and sector rotation signals. It highlights the importance of staying informed and alert in the face of mixed signals that could potentially lead to hesitations in investment decisions.

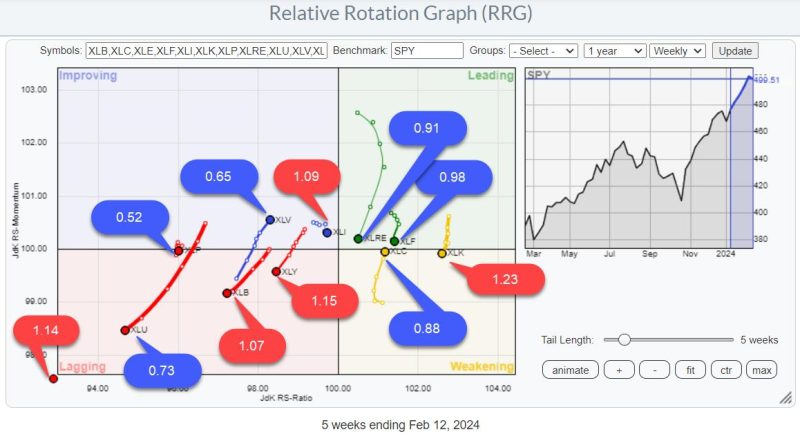

The article begins by emphasizing that the spy uptrend remains intact despite signs of hesitation in sector rotations. This indicates that there is still underlying strength in the overall market trend. However, it warns that mixed signals in sector rotation could impact individual stock performances and require investors to adjust their strategies accordingly.

The author points out that recent market movements have shown a lack of clear direction, with some sectors outperforming while others lag behind. This suggests that investors may need to navigate carefully and be selective in their stock choices, taking into account not just the overall market trend but also the shifts in sector dynamics.

Furthermore, the article emphasizes the importance of paying attention to key levels and indicators that can help identify potential turning points in the market. By remaining vigilant and monitoring these signals, investors can better position themselves to capitalize on emerging opportunities and protect their investments from downside risks.

In conclusion, the article underscores the need for investors to stay proactive and adaptable in response to changing market conditions. By staying informed, monitoring sector rotations, and being prepared to adjust their strategies, investors can navigate through uncertainties and make well-informed decisions that align with their financial goals.