Sentiment and Small Caps: The Winning Combination for Investors

Understanding market sentiment and paying attention to small-cap stocks could be the winning combination for investors looking to navigate the ups and downs of the stock market. By focusing on these two key aspects, investors may be able to gain an edge and outperform the market, especially in volatile times. Let’s delve deeper into how sentiment and small caps act as a 1-2 punch knocking out the staggering bears.

**The Power of Sentiment**

Market sentiment, often driven by emotions, can play a significant role in stock price movements. When investors are optimistic about the market or a particular stock, prices tend to rise as demand increases. Conversely, during periods of pessimism or fear, prices can drop as investors sell off their holdings.

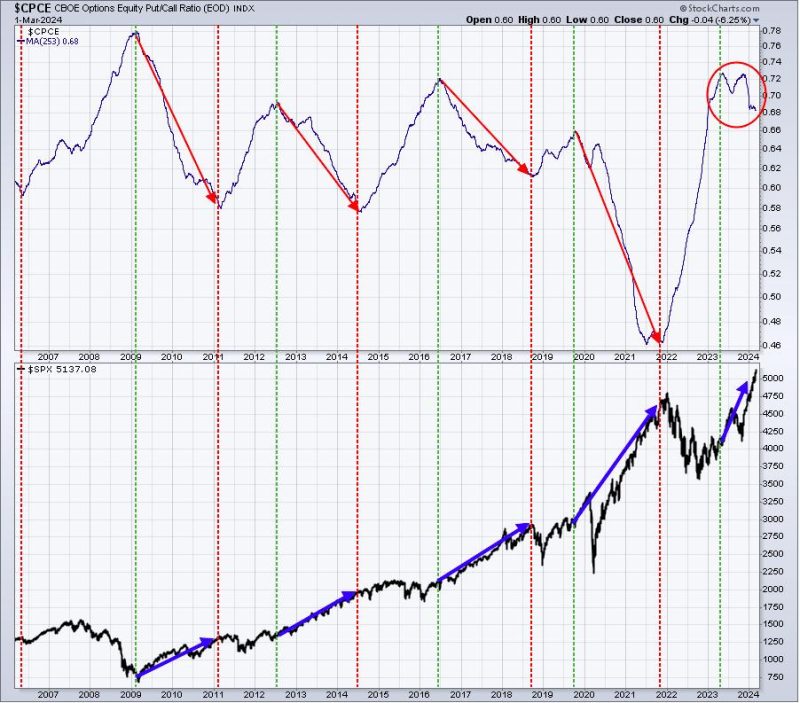

Understanding and analyzing market sentiment can give investors insights into the overall mood of the market and potential future price movements. Various indicators, such as the VIX (Volatility Index) or investor surveys, can help gauge sentiment and provide valuable information for investors.

By staying attuned to market sentiment, investors can make more informed decisions about when to buy, sell, or hold onto their investments. Utilizing sentiment analysis tools and staying updated on market news and trends can help investors stay ahead of the curve.

**The Allure of Small Caps**

Small-cap stocks, companies with relatively small market capitalizations, can offer investors significant growth potential. These companies are typically in their early stages of development and often have more room to grow compared to larger, established companies.

Investing in small caps can be a way for investors to capitalize on emerging trends and innovative ideas. These stocks can be more volatile than large-cap stocks, but with higher risk comes the potential for higher returns.

Additionally, small caps are sometimes overlooked or under-researched by analysts and institutional investors, providing an opportunity for individual investors to discover hidden gems before they gain broader attention.

**The Winning Combination**

When combining a focus on sentiment with an eye on small-cap stocks, investors may have a winning strategy on their hands. Sentiment analysis can help identify potential shifts in market direction, while investing in small caps can offer the prospect of outsized returns.

During periods of positive sentiment, small caps may see even greater appreciation as investors flock to riskier assets in search of growth opportunities. Conversely, when sentiment sours, small caps may be disproportionately impacted, presenting buying opportunities for contrarian investors.

By staying disciplined, conducting thorough research, and remaining informed about market sentiment and small-cap opportunities, investors can build a resilient and potentially lucrative investment portfolio.

In conclusion, sentiment and small caps can indeed be a potent 1-2 punch for investors looking to navigate the stock market successfully. By understanding market sentiment and capitalizing on the growth potential of small-cap stocks, investors can enhance their chances of achieving their financial goals and outperforming the market in the long run.