**Understanding Bullish Gap Down Reversals for Profitable Trading**

In the world of financial markets, traders are constantly seeking ways to maximize profits and minimize risks. One particular trading strategy that has caught the attention of many traders is the Bullish Gap Down Reversal. This strategy involves identifying a specific pattern in the price movement of a stock that signals a potential turnaround in its trajectory. By understanding and effectively utilizing Bullish Gap Down Reversals, traders can capitalize on lucrative opportunities in the market.

**What is a Bullish Gap Down Reversal?**

A Bullish Gap Down Reversal occurs when a stock opens significantly lower than its previous closing price, creating a gap down on the price chart. However, instead of continuing its downward trend, the stock quickly reverses direction and begins to move upwards. This sudden shift in momentum signals a potential buying opportunity for traders who are able to identify and act on it.

**Key Elements of Bullish Gap Down Reversals**

Several key elements characterize a Bullish Gap Down Reversal and distinguish it from other price movements:

1. **Large Price Gap Down**: The stock must open at a price significantly lower than its previous closing price, creating a noticeable gap on the price chart.

2. **Sudden Reversal**: Following the gap down, the stock must quickly reverse its direction and start moving upwards. This swift change in momentum is a crucial indicator of a potential Bullish Reversal.

3. **Increased Volume**: A Bullish Gap Down Reversal is often accompanied by a surge in trading volume, indicating increased interest and participation from traders.

4. **Confirmation Signals**: To validate a Bullish Reversal, traders may look for additional confirmation signals such as bullish candlestick patterns or technical indicators that support the reversal thesis.

**Trading Strategies for Bullish Gap Down Reversals**

Successfully profiting from Bullish Gap Down Reversals requires a well-defined trading strategy and disciplined execution. Here are some key strategies that traders can employ to maximize their profits:

1. **Entry and Exit Points**: Identify precise entry and exit points based on the price action and confirmation signals. This includes setting stop-loss orders to manage risks and protect profits.

2. **Risk Management**: Implement proper risk management techniques such as position sizing and risk-reward ratios to ensure that losses are minimized and profits are maximized.

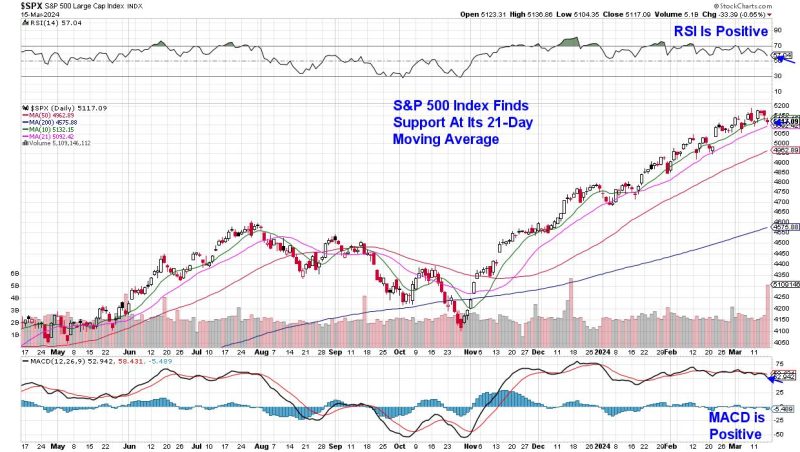

3. **Technical Analysis**: Utilize technical analysis tools and indicators such as moving averages, trendlines, and volume analysis to confirm the validity of the Bullish Reversal pattern.

4. **Psychological Factors**: Be mindful of investor sentiment and market psychology, as these factors can influence the success of a Bullish Gap Down Reversal trade.

**Conclusion**

In conclusion, Bullish Gap Down Reversals present unique opportunities for traders to profit from sudden shifts in market sentiment and price momentum. By understanding the key elements of this trading pattern and implementing sound trading strategies, traders can increase their chances of success in capturing profitable trades. As with any trading strategy, thorough research, diligent analysis, and disciplined execution are essential for consistent profitability in the financial markets.