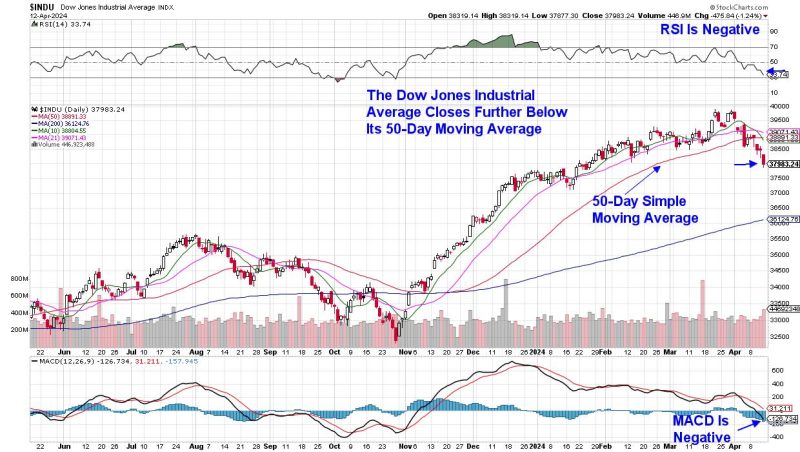

In a recent article published on godzillanewz.com, the discussion revolves around the potential repercussions of weakness in a particular index as a harbinger of a broader market correction. The focal point of the article is the importance of closely monitoring key indices to gauge the overall health of the market and potentially predict future trends.

The article highlights the significance of identifying early warning signs of weakness in certain indices. It emphasizes that weakness in a specific index can serve as an indicator of potential vulnerabilities in the broader market. Investors and analysts who pay attention to these warning signs may have the opportunity to adjust their strategies or take preventative measures before a more significant correction occurs.

Furthermore, the article delves into the complexities of market dynamics and the interconnectedness of various indices. It discusses how weakness in one index can have ripple effects throughout the market, impacting investor sentiment, asset prices, and overall market stability. By staying informed and attuned to these interdependencies, market participants can better position themselves to navigate potential corrections or downturns.

The article also touches on the importance of conducting thorough research and analysis when interpreting market signals. It stresses the need for a holistic view that takes into account a range of factors, such as economic indicators, geopolitical events, and industry-specific trends. By incorporating a comprehensive approach to market analysis, investors can make more informed decisions and mitigate risks associated with market corrections.

Overall, the article underscores the critical role that indices play in monitoring market health and identifying potential vulnerabilities. By actively monitoring these indicators and understanding their implications, investors can better position themselves to navigate market fluctuations and make informed investment decisions. In a volatile and dynamic market environment, staying informed and proactive is key to managing risks and capitalizing on opportunities.