The upcoming week for the Nifty may be characterized by subdued trading activity, with a bias towards defensive plays. Market participants can expect a truncated week, which may influence trading patterns and investor sentiment. The uncertainties surrounding global economic conditions, geopolitical tensions, and domestic factors may contribute to the cautious approach among investors.

Technical Analysis:

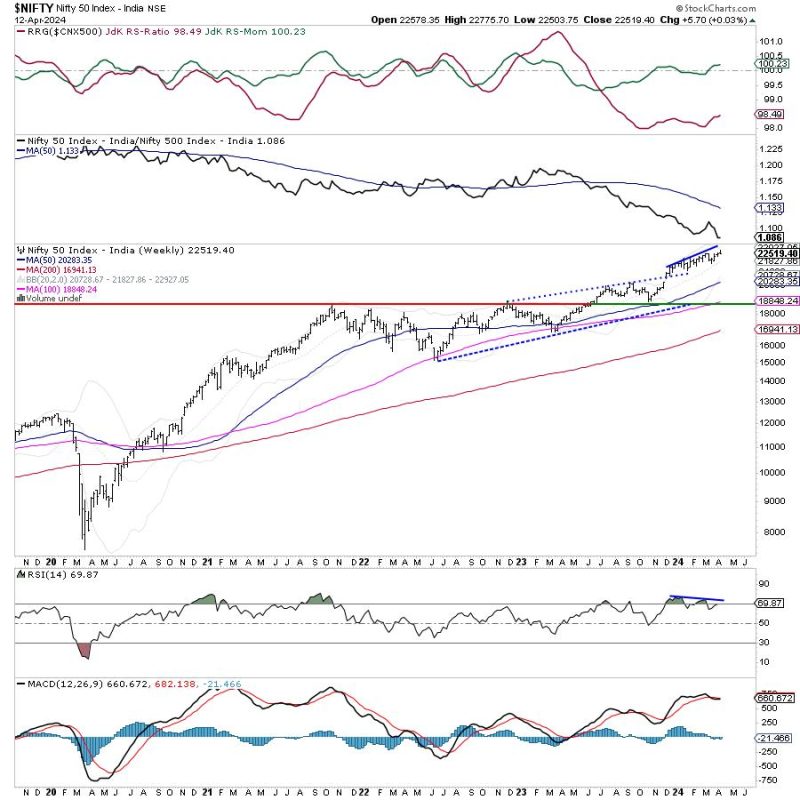

From a technical standpoint, the Nifty index may continue to face resistance at key levels, limiting upside potential. Traders and investors should closely monitor important support and resistance levels to gauge market direction. Volatility may also play a significant role in the trading dynamics, as sudden market moves can impact investor confidence.

Sectoral Trends:

During the upcoming week, specific sectors such as pharmaceuticals, IT, and FMCG may exhibit relative strength due to their defensive qualities. Investors may shift their focus towards these sectors as a hedge against market volatility and uncertainties. It is essential to conduct thorough sectoral analysis to identify potential opportunities and risks in the current market environment.

Market Sentiment:

Market sentiment is likely to be influenced by a combination of domestic and international factors. Traders should pay close attention to macroeconomic indicators, corporate earnings, and geopolitical developments to gauge investor sentiment. Any unexpected news or events can trigger sharp market movements, necessitating a prudent risk management approach.

Risk Management:

Amidst the uncertainties and potential market risks, it is crucial for traders and investors to implement robust risk management strategies. Utilizing stop-loss orders, diversifying portfolios, and maintaining a disciplined approach to trading can help mitigate potential losses. Market participants should also stay informed about market developments and adjust their positions accordingly.

Conclusion:

In conclusion, the upcoming week for the Nifty is anticipated to be subdued, with a defensive bias in play. Investors should remain cautious and vigilant, closely monitoring market trends and key support/resistance levels. By conducting thorough analysis, implementing effective risk management strategies, and staying informed about market dynamics, traders can navigate the current market conditions successfully. It is essential to adapt to changing market scenarios and make well-informed decisions to optimize trading outcomes.