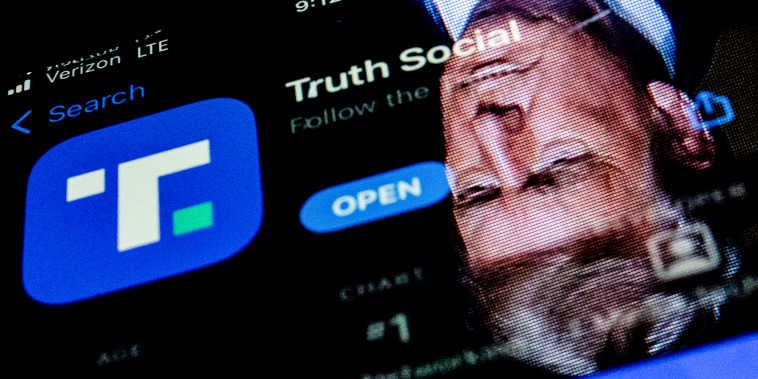

The recent move by Trump Media & Technology Group to file for issuing additional DJT stock has sent shockwaves through the financial world, with media shares plunging in response. This decision raises several important questions and considerations for investors, analysts, and the broader public.

The announcement of Trump Media & Technology Group’s plans to issue more DJT stock comes at a time when the company is in the midst of significant growth and expansion efforts. The move suggests that the company is looking to raise capital to fund its ambitious plans for the future. However, the decision has raised concerns among investors about the potential dilution of existing shares and its impact on the company’s stock price.

One of the key implications of the company’s decision is the impact on its media shares, which have plunged in response to the news. This reaction highlights the sensitivity of the market to announcements related to stock issuances and the potential implications for shareholder value. Investors will be closely monitoring the company’s performance in the coming months to gauge the impact of the additional DJT stock on its financial health and market standing.

Furthermore, the decision by Trump Media & Technology Group to issue more DJT stock raises questions about the company’s overall strategy and long-term vision. Investors will be looking for clear communication from the company’s management team regarding how the proceeds from the stock issuance will be utilized and the expected benefits for shareholders. Transparency and accountability will be crucial in maintaining investor confidence and trust in the company’s leadership.

Beyond the immediate impact on media shares, the decision to issue additional DJT stock also points to broader trends in the media and technology industries. As companies seek to capitalize on the growing demand for digital content and innovative technologies, they must navigate complex financial decisions that can have far-reaching consequences. The Trump Media & Technology Group’s move serves as a reminder of the dynamic and competitive nature of these industries and the importance of strategic planning and risk management.

In conclusion, the recent plunge in media shares following Trump Media & Technology Group’s filing to issue additional DJT stock underscores the challenges and opportunities facing companies in the media and technology sectors. Investors and analysts will be closely monitoring the company’s performance and communication in the coming months to assess the impact of the stock issuance on shareholder value and the company’s long-term prospects. As the company navigates this critical juncture, transparency, strategic vision, and effective risk management will be key to sustaining investor trust and driving future growth.