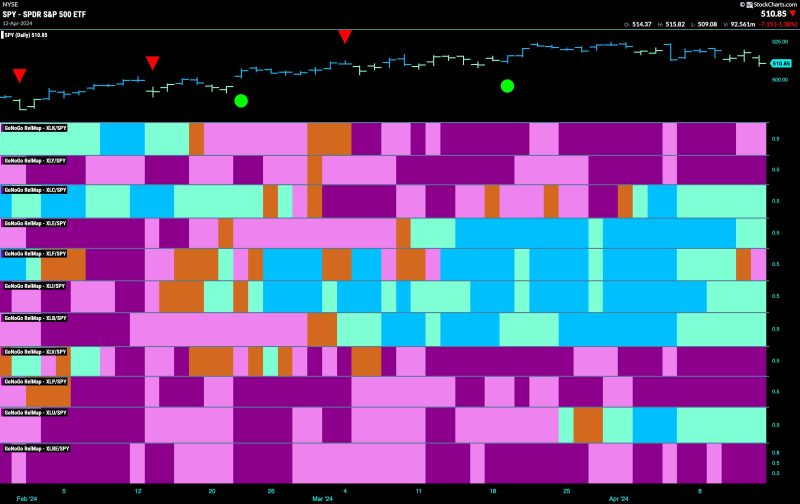

Equity Markets Struggle to Hold Onto Go Trend as Industrials Try to Lead

The equity markets are facing a challenging time as they struggle to maintain the positive momentum of the ‘Go Trend’ that has been prevalent in recent weeks. While some sectors are showing strength, particularly in the industrial space, overall market conditions are shaky, prompting investors to tread cautiously.

Industrial stocks have emerged as the frontrunners in this uncertain market environment, with companies in sectors such as manufacturing, transportation, and construction showing resilience amid broader market volatility. This trend can be attributed to several factors, including strong demand for manufactured goods, infrastructure development projects, and government initiatives to boost the industrial sector.

However, the industrial sector’s outperformance is not widespread across all companies within the sector. Some firms are still grappling with supply chain disruptions, rising input costs, and labor shortages, which are hindering their ability to capitalize on the current market dynamics fully. Investors are advised to carefully evaluate individual industrial stocks based on their specific fundamentals and growth prospects before making investment decisions in this sector.

On the other hand, technology stocks, which have been the primary drivers of the market’s rally in recent years, are currently facing headwinds as investors rotate out of growth-oriented assets and seek safety in more defensive sectors. Concerns about rising inflation, interest rates, and regulatory pressures are weighing on sentiment towards technology stocks, leading to a broader market sell-off in this segment.

Meanwhile, the energy sector is experiencing a mixed performance, with oil prices fluctuating amid geopolitical tensions and supply-demand dynamics. Companies in the oil and gas industry are closely monitoring developments in key oil-producing regions and adjusting their operations accordingly to mitigate risks and capitalize on potential opportunities.

Overall, the equity markets are likely to remain volatile in the near term as investors navigate a complex landscape marked by geopolitical uncertainties, economic indicators, and corporate earnings reports. It is essential for investors to stay informed, diversify their portfolios, and adopt a long-term perspective to navigate the current market conditions successfully.

In conclusion, while industrial stocks are showing resilience and attempting to lead the market higher, investors must exercise caution and conduct thorough research before making investment decisions. By staying informed and adapting to changing market conditions, investors can position themselves to weather the storm and capitalize on opportunities for long-term growth.