The Nifty Fifty has been a rollercoaster ride for investors in recent weeks, navigating through a volatile market environment with sharp swings and unpredictable movements. As the index continues to fluctuate within a defined range, the importance of curtailing leveraged exposures cannot be overstated. This strategic approach is essential for investors looking to mitigate risks and safeguard their portfolios in the face of heightened market uncertainty.

One of the key factors contributing to the ongoing volatility in the Nifty is the prevailing macroeconomic environment. With global uncertainties, geopolitical tensions, and economic challenges weighing on market sentiment, investors are treading cautiously to avoid potential pitfalls. Amidst this backdrop, managing leveraged exposures becomes even more critical, as overleveraging can amplify losses and erode capital significantly in a volatile market scenario.

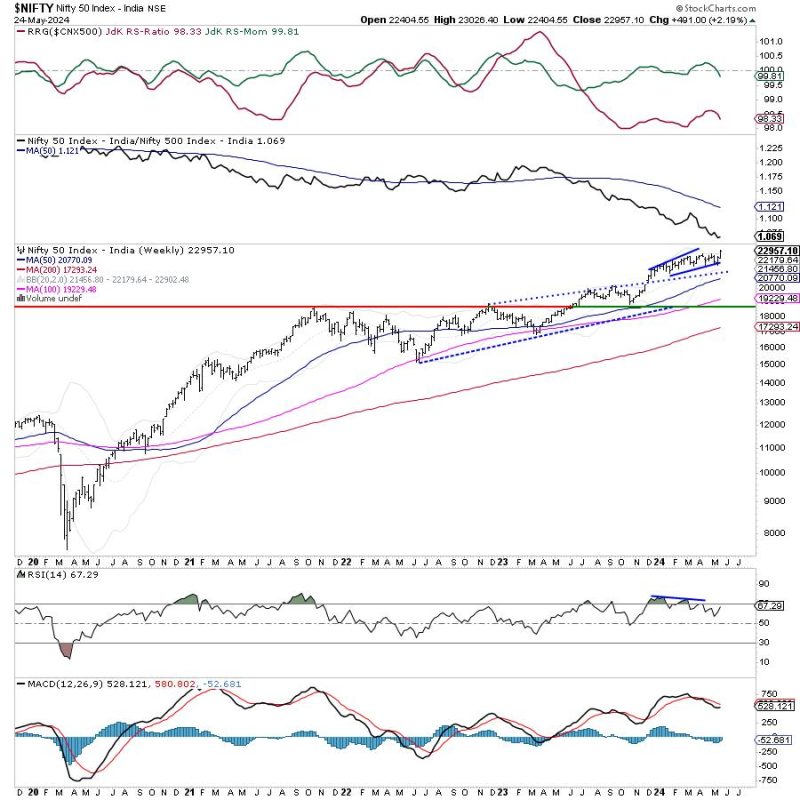

Furthermore, the technical outlook for the Nifty hints at a range-bound movement in the near term, with key support and resistance levels dictating the index’s trajectory. Traders and investors need to exercise caution and closely monitor these levels to make informed decisions and adapt their strategies accordingly. By curtailing leveraged exposures, investors can avoid excessive risks and position themselves more prudently within the uncertain market environment.

In addition to the macroeconomic and technical factors influencing the Nifty’s movements, market participants should also consider the impact of global events and geopolitical developments on market dynamics. Any unexpected news or geopolitical tensions can trigger sharp market reactions, further underscoring the need for risk management and leverage control.

As investors navigate through this volatile market environment, it is imperative to adhere to disciplined risk management practices and maintain a conservative approach towards leveraged exposures. By reducing leverage and adopting a more cautious stance, investors can protect their portfolios against potential downside risks and preserve capital in the face of market turbulence.

In conclusion, the Nifty’s movement within a volatile range underscores the need for investors to exercise caution and prudence in managing their leveraged exposures. By taking proactive measures to curtail leverage, investors can navigate through uncertain market conditions more effectively and safeguard their portfolios against potential risks. As the market continues to face challenges and uncertainties, prioritizing risk management and leverage control remains paramount for prudent investors looking to weather the storm and emerge resilient in the long run.