The Hindenburg Omen has been a subject of discussion among investors and traders in the financial markets for its potential to predict market downturns. Some consider it a reliable indicator, while others approach it with caution due to its complex criteria and historical mixed results.

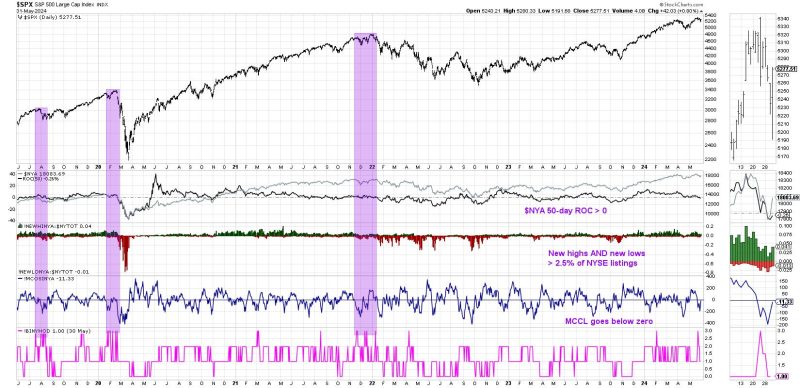

First introduced by Jim Miekka in the mid-1990s, the Hindenburg Omen is based on a set of technical criteria that, when met, signal a potential stock market crash. These criteria include a high number of stocks hitting 52-week highs and lows simultaneously, an increasing number of stocks with new highs and lows, and a rising stock market index. When these conditions align, it can trigger a sell signal, causing concern among market participants.

The recent activation of the Hindenburg Omen, as reported on godzillanewz.com, has sparked a debate among investors about its significance in today’s market environment. While some view it as a warning sign of a looming market correction, others believe that its predictive power may be limited in the current market landscape characterized by unprecedented government interventions and central bank policies.

Historically, instances of the Hindenburg Omen preceding market crashes have been met with mixed outcomes. Some signals have accurately predicted sharp downturns in the stock market, leading to significant losses for investors. However, there have also been instances where the Omen was triggered without resulting in a severe market decline, causing false alarms and unnecessary panic.

It is essential for investors and traders to approach indicators like the Hindenburg Omen with a critical mindset and to consider other factors influencing the market before making significant investment decisions. While technical indicators can provide valuable insights into market sentiment and potential risks, they should be used in conjunction with fundamental analysis and a thorough understanding of market dynamics.

In conclusion, the Hindenburg Omen remains a controversial and debated indicator in the world of finance. Its recent flashing of a sell signal has once again brought attention to its potential implications for the stock market. Investors should exercise caution and conduct thorough research before making investment decisions based solely on technical indicators like the Hindenburg Omen. By combining technical analysis with a deeper understanding of fundamental factors, investors can make more informed and strategic investment choices in today’s complex and unpredictable market environment.