**Analyzing Market Trends with Breadth Indicators**

As investors and traders navigate the volatile waters of financial markets, they often turn to various tools and indicators to gain insights into potential market movements. One such indicator that has gained popularity is the market breadth indicator.

Market breadth indicators analyze the overall health of the market by measuring the number of stocks that are advancing versus declining. By looking beyond individual stock movements and focusing on the breadth of the market, investors can gauge the strength of the current trend and identify potential turning points.

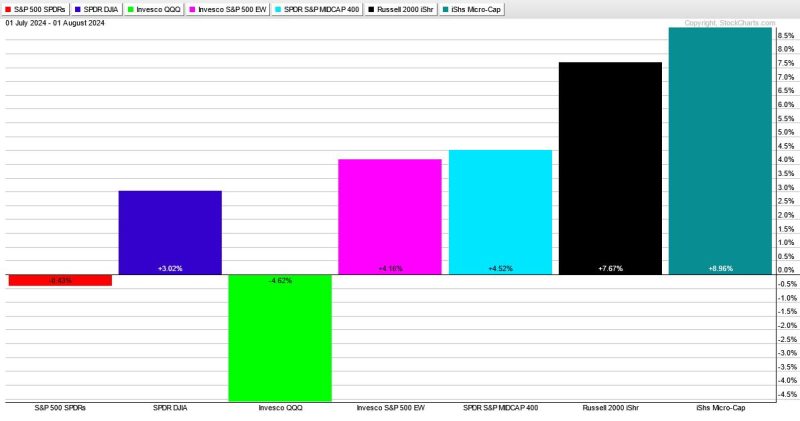

The recent market breadth indicator points to more downside ahead, signaling a potential opportunity for investors to adjust their strategies and take advantage of the changing market conditions. This indicator suggests that the market is experiencing selling pressure and that the current trend may be losing momentum.

While a downward trend can be concerning for investors, it also presents opportunities for those who are prepared to act. By using market breadth indicators as a guide, investors can make informed decisions about when to enter or exit positions, manage risk, and capitalize on potential opportunities.

It is important to note that market breadth indicators are just one piece of the puzzle and should be used in conjunction with other analysis tools and strategies. While they can provide valuable insights into market sentiment and direction, they are not foolproof and should be interpreted in the context of broader market dynamics.

In conclusion, market breadth indicators offer a valuable perspective on market trends and can help investors navigate the complexities of financial markets. By understanding the signals provided by these indicators and incorporating them into their investment strategies, investors can enhance their decision-making process and potentially improve their overall returns in both up and down markets.