The Federal Reserve has played a significant role in shaping the economy of the United States for over a century. Established in 1913, the Fed was designed to provide a stable financial system and promote economic growth. However, over the years, its actions and policies have attracted both praise and criticism.

One of the key criticisms leveled against the Fed is its role in creating economic instability through its monetary policy decisions. By influencing interest rates and controlling the money supply, the Fed has the power to impact borrowing, spending, and investment in the economy. While these tools can help stimulate growth or control inflation, they can also have unintended consequences.

For instance, artificially low interest rates set by the Fed can lead to asset bubbles, as investors seek higher returns in riskier assets. This was evident in the housing bubble of the mid-2000s, fueled by easy credit and lax lending standards. When the bubble burst, it triggered a financial crisis that reverberated across the global economy.

Moreover, the Fed’s quantitative easing programs, initiated in response to the 2008 financial crisis, have been criticized for artificially inflating asset prices and exacerbating income inequality. By pumping trillions of dollars into the financial system to lower long-term interest rates, the Fed has bolstered the stock market and corporate profits, benefiting the wealthy disproportionately.

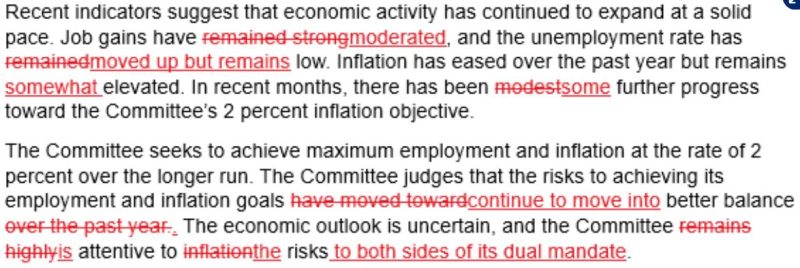

Additionally, the Fed’s dual mandate of maximizing employment and maintaining stable prices can create conflicting priorities. For instance, during periods of high inflation, the Fed may raise interest rates to cool down the economy, leading to job losses. Conversely, during economic downturns, the Fed may lower interest rates to stimulate growth, potentially igniting inflationary pressures.

Critics argue that the Fed’s interventions in the economy distort market signals and prevent the natural ebb and flow of economic cycles. By constantly tinkering with interest rates and flooding the markets with liquidity, the Fed may inadvertently sow the seeds of future crises.

In conclusion, while the Federal Reserve plays a crucial role in maintaining financial stability and promoting economic growth, its actions can have unintended consequences. By being mindful of the risks associated with its policy decisions and fostering transparency and accountability, the Fed can better achieve its dual mandate without creating its own nightmare.