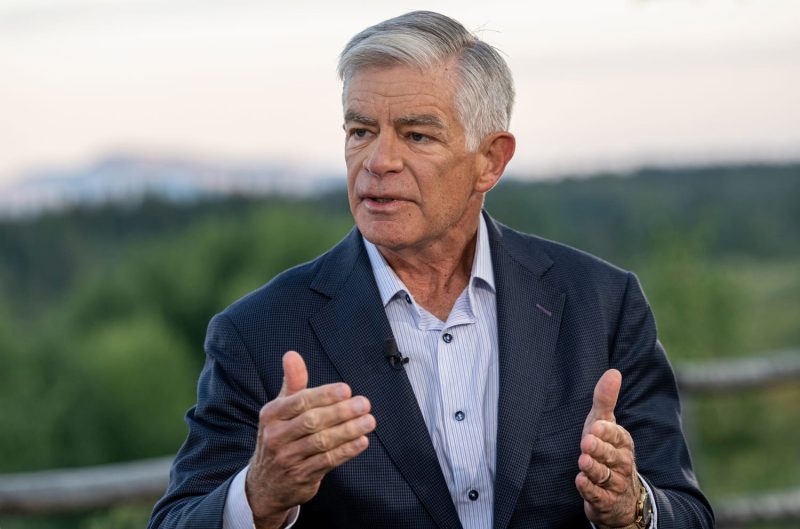

In a recent statement, Philadelphia Fed President Patrick Harker advocated for an interest rate cut in September. Harker’s position on potential rate adjustments reflects the ongoing debate within the Federal Reserve over the appropriate monetary policy to navigate the current economic landscape.

One key factor that Harker highlighted in his argument for a rate cut is the global economic uncertainty stemming from trade tensions and slowing economic growth. With escalating trade disputes between the U.S. and China, as well as other major economies, there are growing concerns about the potential impact on global trade and economic activity. In such a challenging environment, Harker sees proactive monetary policy as a way to support economic expansion and mitigate risks.

Furthermore, Harker emphasized the importance of staying ahead of any potential economic downturn by using monetary policy tools effectively. By lowering interest rates, the Federal Reserve aims to stimulate borrowing and spending, which could help bolster economic growth and offset any negative effects from external shocks. Harker’s advocacy for a rate cut in September signals his belief in the need for preemptive measures to sustain the economic momentum.

It is worth noting that Harker’s position is not isolated within the Federal Reserve system. Other policymakers have also expressed concerns about the global economic outlook and the implications for the U.S. economy. The debate over the appropriate monetary policy response underscores the complexity of the current economic environment and the challenges facing central banks in navigating uncertain waters.

At the same time, the decision to cut interest rates is not without its own set of considerations and potential consequences. While a rate cut could provide a stimulus to the economy, it also raises questions about the effectiveness of monetary policy tools in the face of structural challenges such as low productivity growth and demographic shifts. Policymakers must carefully weigh these factors in determining the best course of action.

In conclusion, Philadelphia Fed President Patrick Harker’s advocacy for an interest rate cut in September reflects the broader discussions within the Federal Reserve about the appropriate monetary policy response to current economic challenges. By highlighting the need for proactive measures to support economic growth and mitigate risks, Harker’s position adds to the ongoing debate about the future direction of monetary policy in the United States.