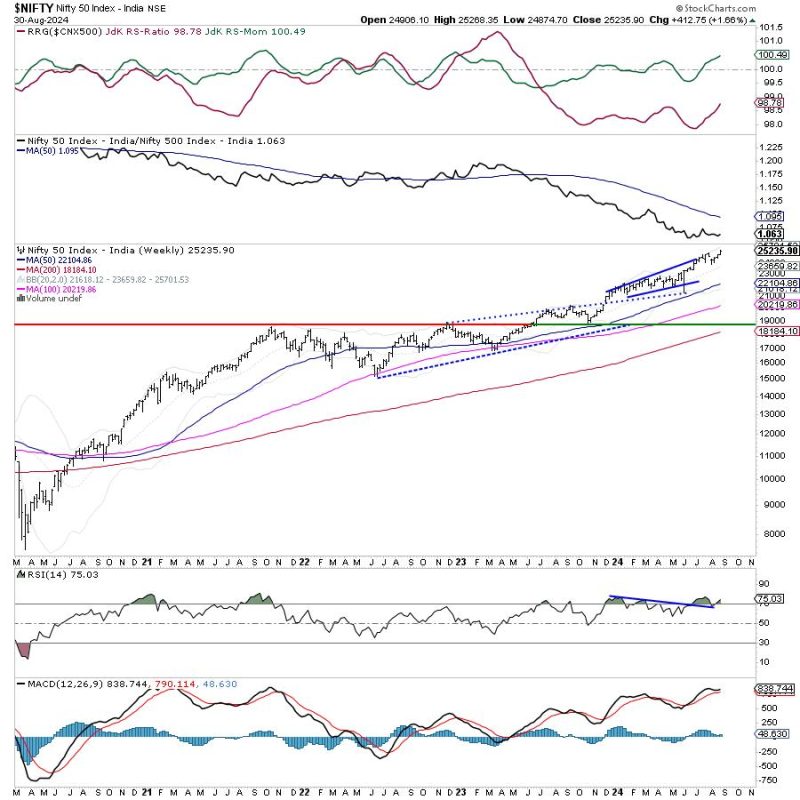

In the ever-evolving landscape of financial markets, it becomes crucial for investors to stay abreast of the latest trends and indicators that can shape the future direction of their investments. One noteworthy tool that has gained popularity in recent years is the Relative Rotation Graph (RRG), which offers a visual representation of the strength and momentum of various assets or securities relative to a benchmark.

As we look ahead to the coming weeks, it is evident from the RRG analysis that the uptrend for Nifty remains intact, despite some signs of a defensive setup. This information can be invaluable for investors looking to make informed decisions about their portfolio allocations and trading strategies.

The RRG reveals the relative strength and momentum of different sectors within an index, offering insights into which areas of the market are gaining or losing steam. In the current scenario, the defensive sectors such as IT and FMCG are displaying distinctly defensive postures, indicating a shift towards safety and stability in the broader market sentiment.

On the other hand, sectors like Metals, Commodities, and Financials are positioned in the weakening quadrant, suggesting a potential slowdown in momentum and relative strength compared to the broader market. This could imply a rotation away from these sectors in favor of more defensive plays that are perceived as safer during times of uncertainty.

Despite these defensive signals, the overall uptrend for Nifty remains intact, indicating that the market is still biased towards bullish momentum. This could be attributed to various factors such as positive economic data, strong corporate earnings, or favorable government policies that are driving investor confidence and optimism.

For investors, this information can serve as a valuable guide for adjusting their portfolio allocations or trading strategies to align with the prevailing market trends. By keeping a close eye on the RRG and other technical indicators, investors can stay ahead of the curve and make well-informed decisions that are based on data-driven insights rather than speculation or emotion.

In conclusion, the RRG analysis provides a powerful tool for investors to navigate the complexities of the financial markets and make informed decisions about their investments. By understanding the relative strength and momentum of different sectors within an index, investors can identify potential opportunities and risks, helping them stay ahead of market trends and position their portfolios for success in the weeks ahead.