Certainly! Here is a unique and structured article based on the reference link provided:

Equities Say Go Fish: How Healthy Are the Markets?

Equities have been singing a new tune lately, with the markets making some intriguing moves. As investors navigate the ups and downs, it becomes crucial to assess the health of the markets to make informed decisions. So, let’s dive deep into the current state of the equities market waters.

Market Volatility: A Rollercoaster Ride

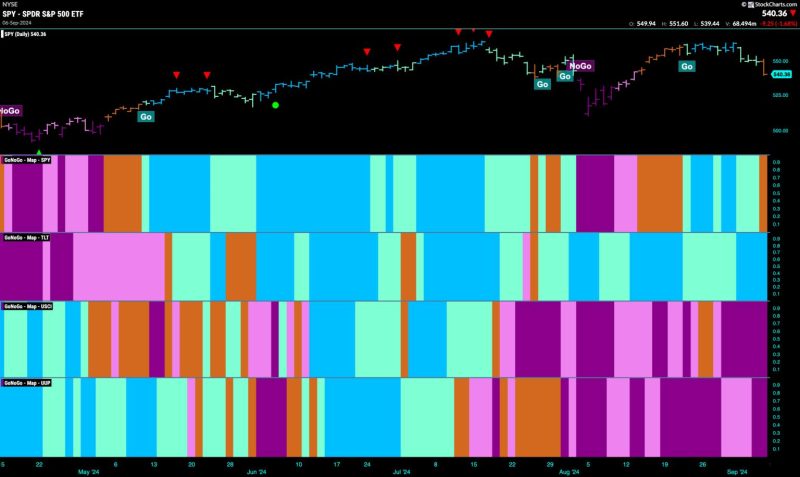

One of the key indicators of market health is volatility. Recent market trends have displayed significant swings, with volatility levels hitting highs and lows like a rollercoaster ride. This rollercoaster has been mainly fueled by global economic uncertainties, geopolitical tensions, and changing monetary policies.

Analysts are closely monitoring the VIX (CBOE Volatility Index) to gauge the market sentiment and risk perception among investors. Rapid fluctuations in the VIX can signal potential market turbulence, while a stable index could indicate confidence and stability.

Company Performance: Building Strong Foundations

Beyond market volatility, the performance of individual companies is a crucial factor in assessing market health. The earnings reports of companies across various sectors provide valuable insights into their financial well-being and growth prospects.

Investors are analyzing earnings projections, revenue streams, and market share to evaluate the strength of companies in their portfolios. Solid financial fundamentals and strategic planning are essential for companies to weather market uncertainties and sustain growth in the long term.

Trade Wars and Economic Policies: Navigating Choppy Waters

Trade wars and evolving economic policies have added an extra layer of complexity to the equities market landscape. Tariffs, sanctions, and trade negotiations can significantly impact the profitability and competitiveness of companies, leading to market disruptions.

Investors are closely monitoring trade agreements, central bank actions, and government policies to anticipate market movements and adjust their investment strategies accordingly. Understanding the macroeconomic environment is crucial for navigating the choppy waters of the equities market.

Tech Innovation and Disruption: Shaping the Future

The rise of technological innovation and disruption has brought new dynamics to the equities market. Tech companies are driving market trends with groundbreaking products, services, and business models that are reshaping industries.

Investors are keeping a close eye on tech advancements, digital transformations, and emerging trends to identify opportunities for growth and innovation. Companies that embrace technology and adapt to changing consumer preferences are positioned to thrive in the evolving market landscape.

In conclusion, the equities market is a dynamic ecosystem influenced by various factors such as market volatility, company performance, trade wars, economic policies, and tech innovation. By staying informed, conducting thorough research, and seeking expert advice, investors can navigate the complexities of the market and make sound investment decisions. Remember, in the game of equities, it’s essential to stay afloat and adapt to the changing tides of the market.