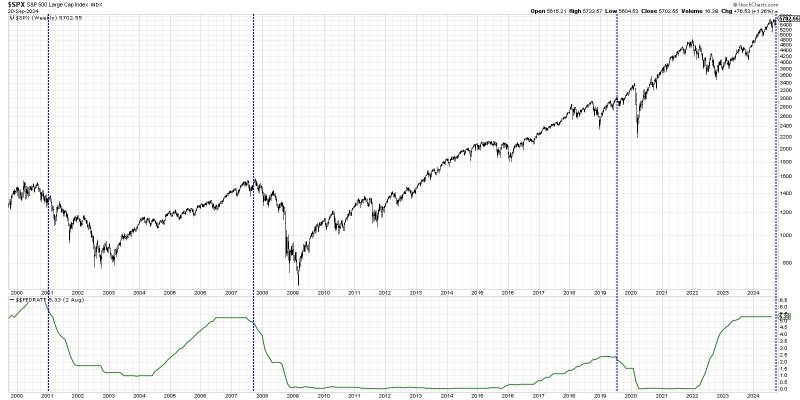

In the world of finance and investments, the correlation between interest rate cuts and stock market performance is a topic of continuous debate among analysts and investors alike. The argument for whether rate cuts are bullish or bearish for the stock market is nuanced and depends on various factors that impact the market dynamics. Let’s delve into the intricacies of this relationship to understand the truth about rate cuts and stock performance.

One school of thought suggests that rate cuts are bullish for the stock market. The rationale behind this argument is rooted in the idea that lower interest rates lead to cheaper borrowing costs for businesses. When companies can borrow money at lower rates, they are more inclined to invest in growth initiatives, such as expanding operations, developing new products, or investing in acquisitions. These investments can potentially drive up corporate earnings and stock prices, leading to a positive impact on the market.

Moreover, lower interest rates often stimulate consumer spending and borrowing as well. When individuals have access to cheaper credit, they are more likely to make big-ticket purchases like homes, cars, and appliances. This increase in consumer spending can bolster the revenues and profitability of companies, contributing to a favorable stock market environment.

On the flip side, there is an argument that rate cuts can be bearish for the stock market under certain circumstances. One of the concerns is that aggressive rate cuts by central banks may signal underlying economic weakness or instability. Investors may interpret frequent rate cuts as a sign that policymakers are trying to stimulate a flagging economy, which could lead to dampened investor confidence and heightened market volatility.

Furthermore, in a low-interest-rate environment, fixed-income investments like bonds become less attractive for investors seeking yield. As a result, some investors may shift their allocation away from bonds and towards equities, which could lead to inflated stock prices that are not necessarily supported by strong fundamentals. This scenario raises the specter of a market bubble that could eventually burst, leading to a downward correction in stock prices.

It’s essential to recognize that the impact of rate cuts on stock market performance is not a one-size-fits-all proposition. Market reactions to interest rate changes are influenced by a multitude of factors, including the overall economic environment, corporate earnings prospects, geopolitical developments, and investor sentiment.

Ultimately, investors should consider a holistic approach to analyzing the effects of rate cuts on stock performance. By examining a broad range of economic indicators and market trends, investors can make more informed decisions about their investment strategies in response to interest rate changes.

In conclusion, the relationship between rate cuts and stock market performance is complex, with multiple variables at play. While rate cuts can have a bullish effect on the stock market by stimulating economic activity and bolstering corporate earnings, they can also introduce risks such as market overheating and economic fragility. Investors should carefully evaluate the broader economic landscape and exercise prudence when navigating the waters of rate cuts and their implications for stock performance.