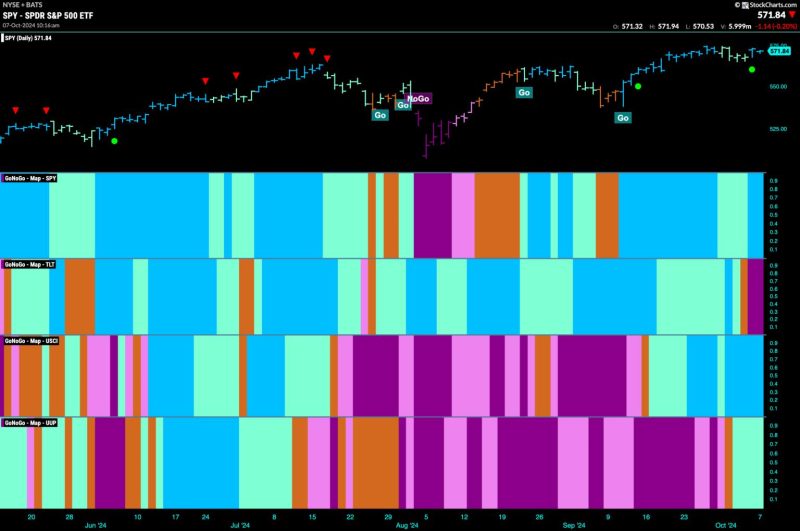

Equities Remain in ‘Go’ Trend and Lean into Energy

The global equity markets have continued their upward trajectory, fueled by an optimistic outlook on economic recovery and corporate earnings. Despite initial uncertainties stemming from the ongoing pandemic, the past few months have seen a steady stream of positive data and market performance.

One sector that has notably outperformed is the energy sector. After years of underperformance and uncertainty, energy stocks have experienced a resurgence in investor interest and activity. The rebound can be attributed to several factors, such as increasing oil prices, growing demand for energy products, and the shift towards renewable energy sources.

Oil prices have been on an upward trend, propelled by improving global demand as economies reopen and supply constraints in key oil-producing regions. This has resulted in higher profitability for energy companies and boosted investor confidence in the sector. Additionally, the transition towards renewable energy sources has created new opportunities for energy companies to diversify their portfolios and capitalize on the shift towards cleaner energy.

Investors are increasingly drawn to energy stocks due to their attractive valuations and growth potential. Many companies in the sector have implemented cost-cutting measures and operational efficiencies to improve their bottom line, making them more resilient to market fluctuations. This, coupled with the overall positive sentiment surrounding the sector, has bolstered investor interest and pushed energy stocks higher.

Another key driver of the equity markets’ uptrend is the continued support from central banks and governments worldwide. Stimulus measures, low interest rates, and fiscal policies have provided a strong tailwind for equities, encouraging investors to remain bullish on the market.

Looking ahead, the outlook for equities remains positive, with many analysts expecting the upward trend to persist in the near term. However, investors should remain vigilant and consider diversifying their portfolios to mitigate risks and capitalize on emerging opportunities.

In conclusion, the current market environment presents a favorable backdrop for equities, with energy stocks standing out as a prominent performer. As investors navigate the complexities of the market, staying informed and diversified will be key to capitalizing on potential gains and protecting against downside risks.