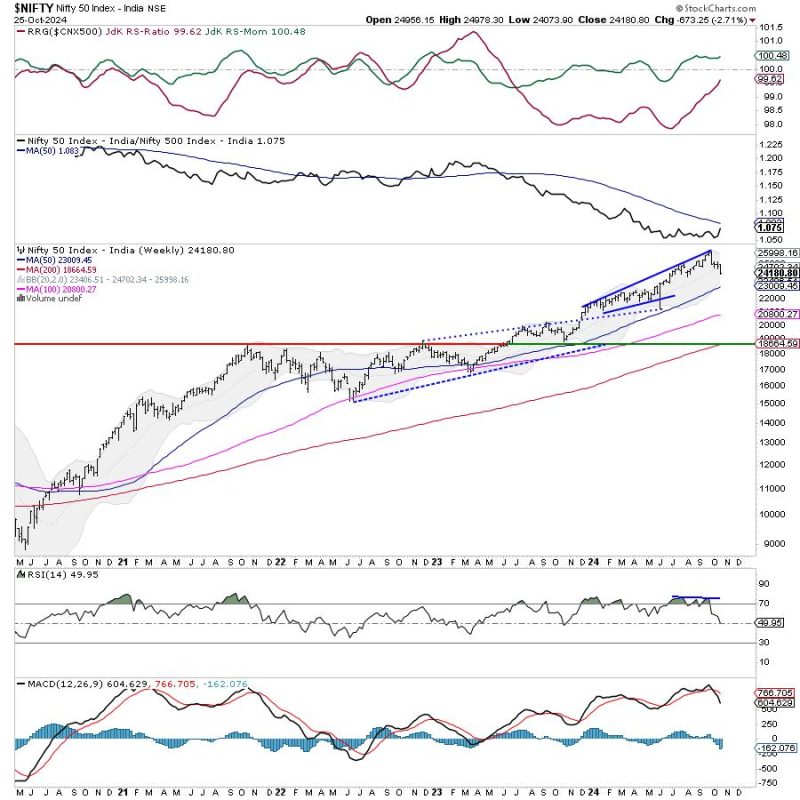

In the wake of recent market events, the Nifty index has been on a rollercoaster ride, violating key support levels and dragging resistance lower. Investors and traders are closely monitoring the developments, analyzing the implications, and positioning themselves accordingly to navigate the uncertainties in the market.

Technical analysis plays a crucial role in understanding market behavior, and in the case of the Nifty index, it has revealed significant shifts. The breach of crucial support levels has sent ripples across the market, prompting market participants to reassess their strategies and risk management. The increasing volatility and uncertainty have added complexity to the trading environment, making it imperative for traders to stay alert and adapt quickly.

The downward momentum in the Nifty index has led to a downward revision of resistance levels, indicating a bearish sentiment prevailing in the market. Traders and investors are closely monitoring these levels to gauge market sentiment and potential price movements. The dynamic interplay between support and resistance levels is a key factor in determining market direction and is closely watched by market participants.

The violation of key support levels has also raised concerns about the sustainability of the current market trend. Traders are cautious about potential downside risks and are actively assessing their positions to manage risk exposure. The uncertainty in the market has highlighted the importance of risk management and disciplined trading practices to navigate the challenging market conditions effectively.

As the Nifty index continues to navigate through turbulent waters, market participants are advised to remain vigilant and proactive in their trading approach. Keeping a close eye on key support and resistance levels, as well as monitoring market developments, is essential to staying ahead of the curve and adapting to changing market dynamics. By staying informed and being prepared for potential market fluctuations, traders can position themselves strategically to capitalize on opportunities and mitigate risks effectively.