US tech stocks have been the hardest hit in recent weeks as Trump’s new trade policies continued to push investors to other sectors and assets in search of stability.

Investors seem increasingly concerned that a global trade war in response to the US tariffs could lead to a broad-based recession that tends to particularly hurt the tech sector.

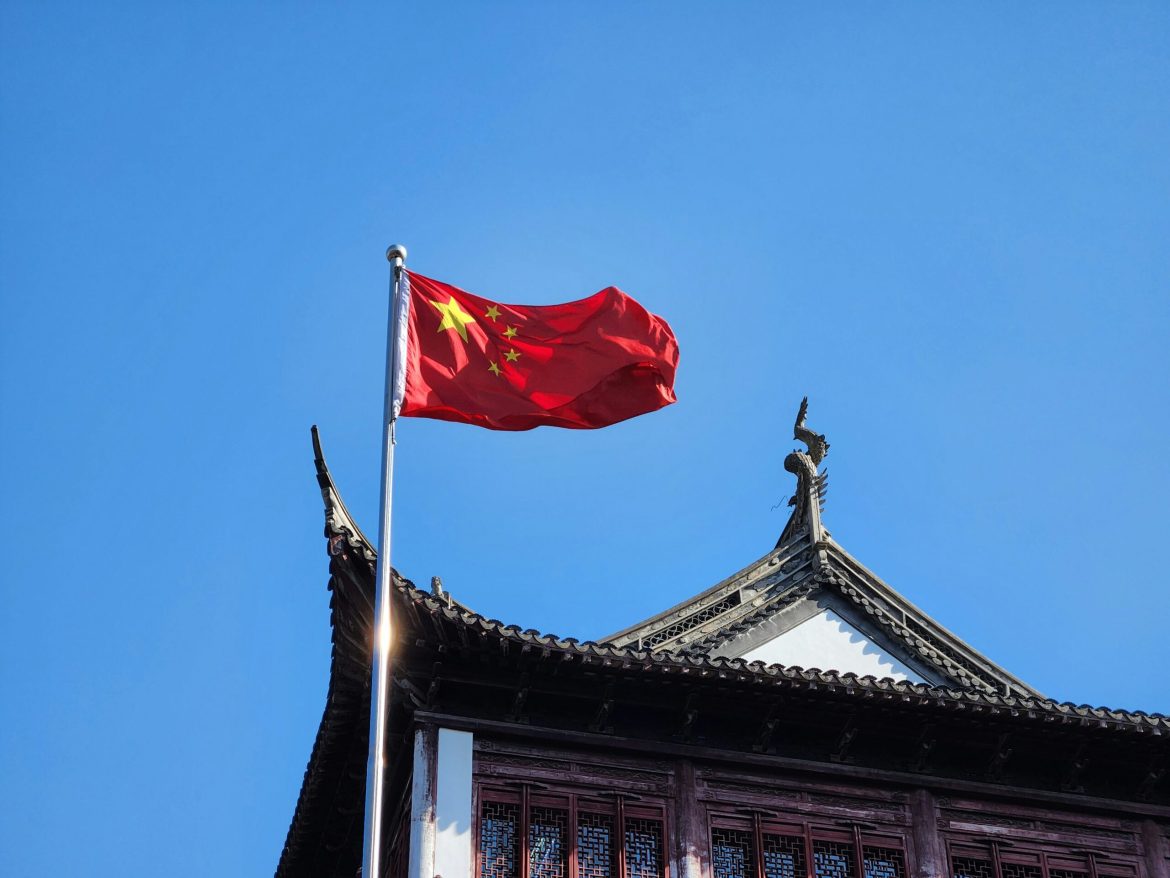

However, experts from several investment firms have a polar opposite view on how to play the Chinese tech stocks in the wake of current macro challenges.

Analysts see Beijing’s tech sector as strongly positioned to navigate the trade war and offer healthy returns over the next 12 months.

Why are Chinese tech stocks attractive in 2025?

Morningstar equity strategist Kai Wang remain bullish on Chinese tech stocks primarily because many of the larger, more renowned names within that space have limited exposure to Trump tariffs.

In a research note last week, Citi analyst Pierre Lau favoured them as well, citing valuations as more attractive in China currently than in the US.

In fact, at writing, the price-to-earnings ratio on the Chinese tech stocks is more than 50% below the multiple on the US “Magnificent Seven” on average.

“We prefer domestic over export plays amid uncertainties stemming from higher tariffs,” he told clients in a recent note, adding the firm also prefers services over goods, and growth over value in 2025.

Global investors are picking China tech over US

Experts are keeping bullish on Beijing’s technology sector as they expect AI advancements to help unlock significant further upside in its equities as well.

According to Citi strategists, global investors have been bailing on US tech stocks this year to park their capital in their Chinese counterparts instead in recent months.

As much as 25% of international investors have turned more constructive on China’s tech stocks, according to the investment firm’s research note.

This is reflected in allocations to Beijing from global emerging markets equity funds, which reached a 16-month high in March, the firm added.

Two Chinese tech stocks to buy in April

Two names in particular that Citi recommends owning for the aforementioned reason amidst the current macroeconomic backdrop include Tencent and BYD.

While tariffs, trade war, and concerns of a potential economic slowdown continue to weigh on US tech stocks, the likes of Tencent and BYD have rallied well over 35% over the past three months.

Tencent even pays a dividend yield of 0.9% at writing, which makes it all the more exciting to own in the current macro environment.

On the other hand, BYD continues to hit new milestones in its competition against Tesla.

Last month, the Chinese EV maker reported well over $100 billion in revenue for 2024, which effectively made it a bigger electric vehicle company by revenue than TSLA.

The post As US tech stocks crater, experts see massive potential in Chinese counterparts appeared first on Invezz