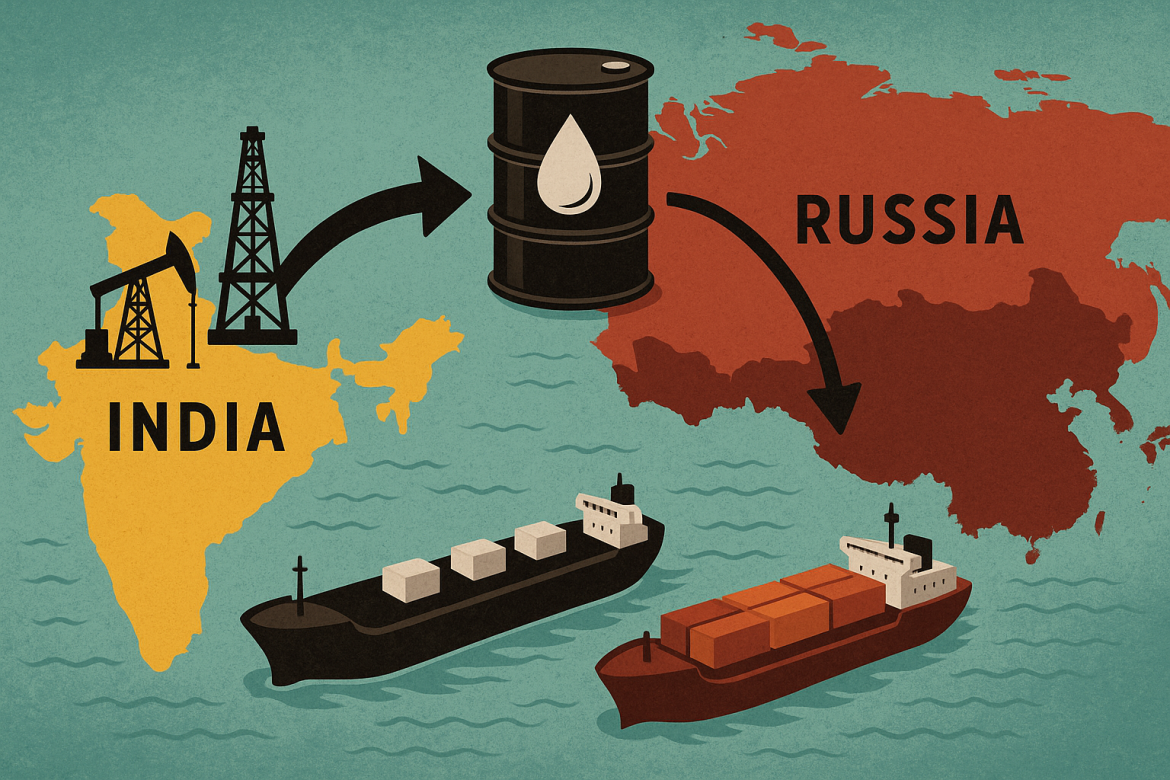

India is entering a new phase in its Russian oil trade as banks develop stricter checks to navigate Washington’s latest sanctions.

Lenders, which only weeks ago were reluctant to clear any payment linked to Russian crude, are now prepared to consider transactions if cargoes come from non-blacklisted sellers and follow every sanctions rule, reported Bloomberg.

The shift reflects India’s need to secure steady fuel supplies while managing heightened global scrutiny, especially as the new US measures took effect on Friday.

Banks tighten checks

Indian banks have created a more structured compliance process to assess payment requests from refiners.

This includes handling settlements in currencies such as UAE dirhams and Chinese yuan.

The new approach emerged after earlier hesitation, when lenders struggled to confirm supply chain details for Russian barrels.

The expanded system now focuses on verifying production sites, cross-checking the origin of the oil, and reviewing the vessels used to transport each shipment.

Vessel histories are being examined more closely, including whether any tanker was involved in ship-to-ship transfers tied to blacklisted entities.

These checks aim to prevent frozen transactions, processing delays, or exposure to secondary sanctions.

Banks and refiners have increased coordination to ensure every link in the chain meets compliance standards before a payment is processed.

Refiners reassess choices

The stronger verification rules follow a period when most Indian refiners avoided placing December orders for Russian crude.

Bloomberg notes that the pause came after the newest US sanctions targeted key producers Rosneft PJSC and Lukoil PJSC, adding to restrictions already affecting Gazprom Neft PJSC and Surgutneftegas PJSC.

These measures disrupted a trade that grew rapidly after Russia’s 2022 invasion of Ukraine, when discounted barrels helped India secure affordable supplies.

With sanctions expanding, refiners are reviewing which suppliers remain safe to engage with.

Even with the updated banking procedures, companies remain cautious because any linkage to a sanctioned firm could freeze payments and create expensive disputes.

This has pushed refiners to spend more time verifying documentation before deciding on shipments.

Flows shift with sanctions

Sanctions have shifted global price dynamics, and Russia’s Urals grade is now trading at a discount of about seven dollars to the Dated Brent benchmark.

Before the newest restrictions, the discount was about three dollars.

The widening gap is creating fresh incentive for Indian refiners to explore compliant Russian options.

For companies operating in a competitive domestic fuel market, price differences of this scale can influence purchasing decisions even when compliance requirements are more complex.

While the updated checks may slow bookings, they also allow some Russian flows to continue instead of collapsing entirely.

The industry expects delays to remain common, but the trade is unlikely to end as long as banks have frameworks to process compliant deals.

Price gap shapes interest

The future of India’s Russian oil trade now depends on how refiners balance risk, pricing, and verification demands.

The deeper Urals discount has made cargoes more attractive, although firms still fear potential payment freezes if a shipment is later linked to a sanctioned entity.

This mix of risk and opportunity is pushing companies to examine every detail of each cargo before committing.

The post India weighs new Russian oil routes as banks adapt to changing sanctions rules appeared first on Invezz