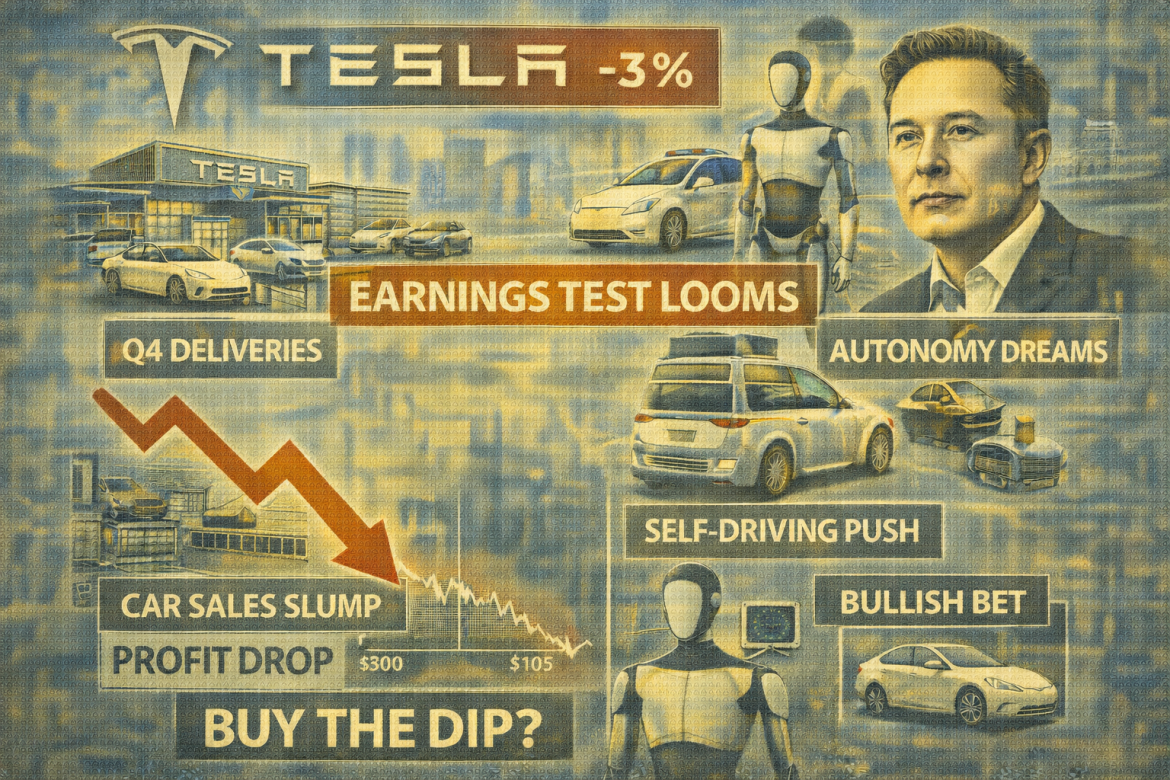

Tesla stock (NASDAQ: TSLA) eased lower on Monday as investors braced for a make‑or‑break earnings week that will test whether Elon Musk’s big autonomy promises really deliver.

The stock traded down roughly 3%, well below its mid‑December peak near $490, even as the S&P 500 and Nasdaq inched higher ahead of a key Federal Reserve decision.

The tension heading into Tesla’s January 28 report is straightforward.

Vehicle deliveries are falling, profit margins have shrunk, and Wall Street expects another double‑digit drop in quarterly earnings.

Yet much of Tesla’s $1.4 trillion market value still rests on future software and robotaxi dreams rather than today’s car sales.

Delivery slowdown and margin fears are driving the pullback

The immediate pressure on the stock stems from Tesla’s fourth‑quarter delivery update.

On January 2, the company reported it built about 434,000 vehicles and delivered 418,227 in Q4 2025, down roughly 15–16% from the same quarter a year earlier.

Full‑year deliveries fell around 9%, the second annual decline in a row, as the loss of a $7,500 US EV tax credit intensified Chinese and European competition.

Those weaker volumes are feeding straight into Wall Street’s earnings models.

Tesla’s own company‑compiled consensus points to Q4 revenue of about $24.5 billion and non‑GAAP earnings of $0.44 a share, implying a near‑40% year‑on‑year profit drop and a low‑single‑digit decline in sales.

Analysts see full‑year 2025 EPS down more than 30%, before only a modest recovery in 2026.

Margins are the other sore spot. Tesla’s total gross margin is expected to land near 17% for the quarter, less than half the levels seen at the peak of the pandemic EV boom.

There are bright spots. Energy storage deployments hit a record 14.2 gigawatt‑hours in Q4, and analysts expect Tesla’s energy and services businesses together to generate more than $7 billion in quarterly revenue.

But for now, those higher‑margin businesses are still too small to fully offset a weaker EV franchise.

Should you buy the dip?

The bigger question is whether Tesla is still primarily a car company or an autonomy and robotics platform in waiting.

On one side, investors remain captivated by Musk’s promises.

At the World Economic Forum in Davos, he talked up the prospect of Full Self‑Driving approval in Europe and China as early as February, large‑scale US robotaxi deployment by year‑end and a consumer version of the Optimus humanoid robot by 2027.

Reuters notes that many on Wall Street now see self‑driving and AI as the key drivers of long‑term value, even as they brace for a roughly 3–4% drop in Q4 sales and a 40% slide in adjusted profit.

On the other side, skeptics argue that the autonomy story is still highly speculative.

Independent analysis suggests Tesla’s camera‑only self‑driving stack has struggled to match human safety levels.

Moreover, the adoption of the paid Full Self‑Driving package remains limited even after Musk cut pricing to a $99 monthly subscription, and regulators have yet to sign off on true driverless fleets.

For potential buyers, the decision comes down to what this week’s numbers and guidance show.

If Tesla can stabilize deliveries, protect or rebuild automotive margins, show stronger cash generation, and provide credible milestones for FSD, bulls will argue that the latest pullback is a chance to buy long‑term optionality at a discount.

If Q4 brings earnings misses, weaker guidance, and vague timelines on autonomy, the market may keep punishing Tesla stock, whose near‑term fundamentals are moving the wrong way.

The post Why is Tesla stock dropping ahead of Q4 earnings: should you buy the dip? appeared first on Invezz