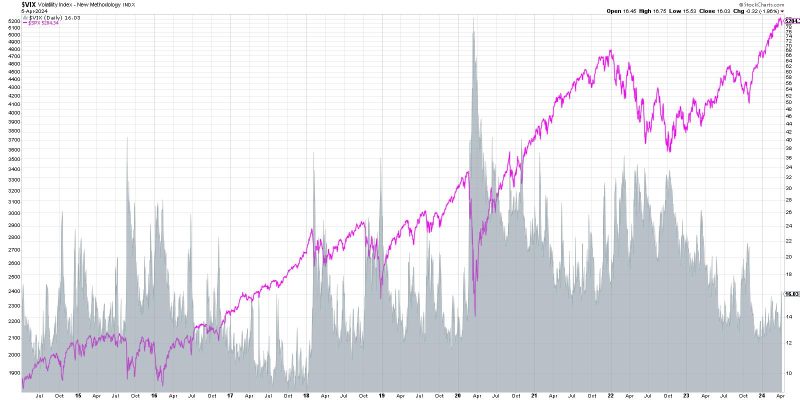

As financial markets continue to navigate through various challenges and uncertainties, one key indicator that tends to capture the attention of many investors is the CBOE Volatility Index (VIX). This metric, often referred to as the fear gauge, provides insights into market sentiment and expectations of volatility. Recently, the VIX spiked above 16, leading many to wonder if this could signal the onset of a more turbulent period in the markets.

The VIX is a measure of implied volatility derived from S&P 500 index options and is widely used by investors to gauge market uncertainty. When the VIX spikes, it typically suggests that market participants are seeking protection against potential downturns or increased volatility in the near future. In the context of the recent spike above 16, it’s important to delve deeper into what factors may be driving this increase and what implications it could have for investors.

One significant factor that could contribute to a rise in the VIX is geopolitical tensions or economic uncertainties. Events such as trade disputes, geopolitical conflicts, or unexpected economic data releases can all trigger a spike in market volatility, leading investors to adjust their risk exposure accordingly. Additionally, concerns about inflation, interest rates, or corporate earnings can also play a role in driving up the VIX.

Another aspect to consider when interpreting a spike in the VIX is the historical context. While a single spike above 16 may not necessarily indicate a prolonged period of market turbulence, sustained high levels of the VIX could signal a more significant shift in market dynamics. Investors should therefore monitor the VIX closely and consider the broader market environment to assess the potential impact on their investment strategies.

Moreover, market participants should be aware that the VIX is not a crystal ball that predicts market movements with absolute precision. It is just one of many indicators that can provide insights into market sentiment and expectations. Investors are encouraged to conduct thorough research, diversify their portfolios, and remain disciplined in their investment approach to navigate through volatile periods successfully.

In conclusion, while a spike in the VIX above 16 may raise concerns among investors, it is essential to approach such events with a clear understanding of the factors driving the volatility and the broader market context. By staying informed, maintaining a long-term perspective, and being prepared to adjust their strategies if necessary, investors can better navigate through uncertain market conditions and position themselves for long-term success.