Nvidia’s stock remains stuck, with shares struggling to regain upward momentum despite the continued expansion of artificial intelligence investment across the technology sector.

The lack of sustained gains reflects a broader rotation away from megacap technology stocks, as well as lingering uncertainty around Nvidia’s exposure to China.

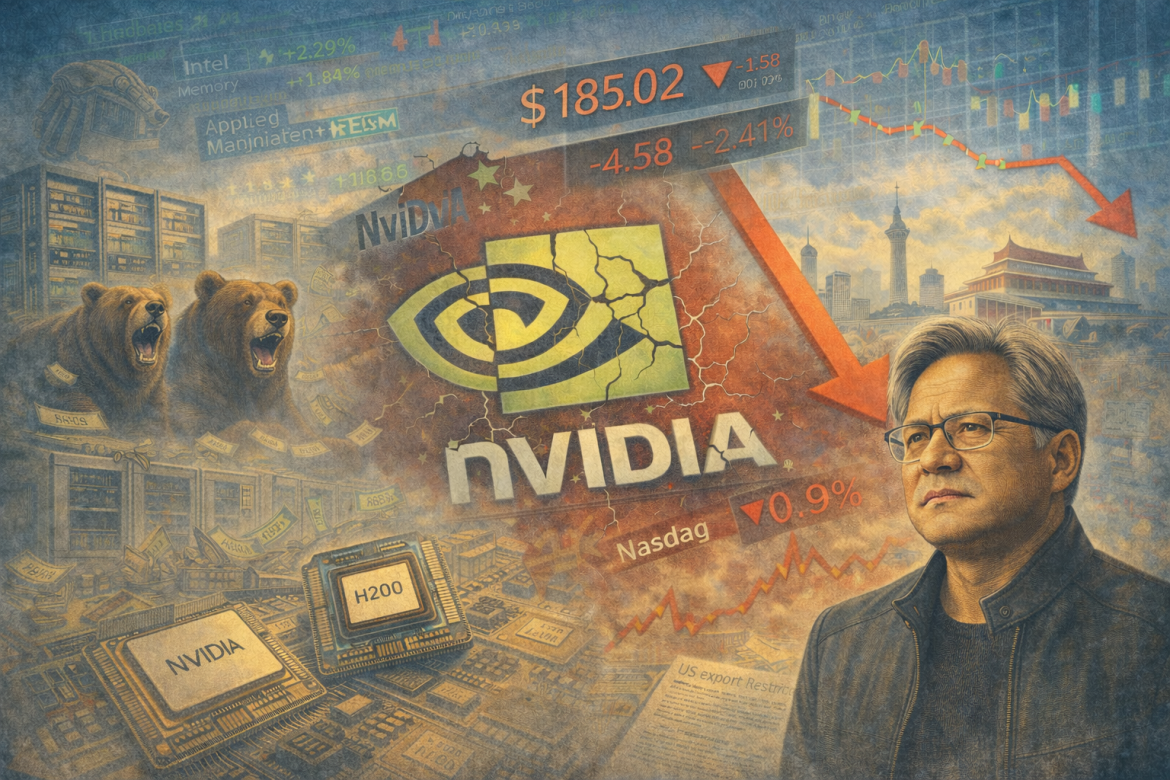

Nvidia shares were up around 0.8% at $185.02 in early trading on Thursday, building on a roughly 3% gain from Wednesday’s session.

Even so, the stock is trading near levels last seen in August, highlighting how little progress it has made over the past several months compared with other parts of the semiconductor and AI ecosystem.

China uncertainty weighs on sentiment

A major factor behind Nvidia’s sideways trading has been months of conflicting signals surrounding its access to the Chinese market, which remains critical to its long-term growth narrative.

Chief executive Jensen Huang has expressed optimism that US export approvals could allow Nvidia to resume shipments of its H200 artificial intelligence chip to China.

However, that optimism has been repeatedly tempered by regulatory uncertainty in Beijing.

Reports that Chinese authorities have paused orders, combined with indications that any approvals may be selective rather than broad-based, have clashed with investor hopes for a potential $54 billion revenue opportunity.

The situation has revived memories of last year’s $5.5 billion inventory write-down, when abrupt policy shifts cut off Nvidia’s ability to sell chips designed for China.

That geopolitical tug-of-war continues to obscure Nvidia’s near-term outlook, leaving investors unsure whether the Chinese market will become a growth catalyst or remain a persistent overhang.

Rotation within the AI trade

At the same time, investor enthusiasm within the AI theme seems to have shifted toward other segments of the semiconductor industry.

Memory-product makers such as Micron Technology have attracted strong inflows, as have manufacturers of semiconductor production equipment like Applied Materials, which benefit from rising capital expenditure across the chip supply chain.

Intel has also emerged as a standout performer, as investors bet on a recovery in its server and PC businesses.

These rotations have diluted demand for Nvidia shares, even as the company remains the dominant supplier of high-end AI accelerators.

“The market capitalisation for the front line AI stocks like Nvidia…have risen so much and they have become such a large portion of key benchmarks that it makes it hard for many investors to own significantly more of these stocks,” UBS analyst Timothy Arcuri wrote in a research note this week.

Political resistance builds in Washington

Nvidia’s challenges are not limited to market dynamics. President Donald Trump’s plan to grant licenses allowing Nvidia to ship more powerful AI chips to China has triggered growing resistance among Washington lawmakers, including members of the president’s own party.

The pushback intensified this week when the US House of Representatives Foreign Affairs Committee advanced legislation aimed at tightening congressional oversight of AI chip exports.

The proposed measure, known as the AI Overwatch Act, was introduced last month by Rep. Brian Mast, R-Fla., who chairs the committee.

Under the bill, both the House Foreign Affairs Committee and the Senate Banking Committee would be required to approve licenses for advanced AI chip shipments within 30 days. Lawmakers would have the power to block exports through a joint resolution.

If enacted, the AI Overwatch Act would revoke existing licenses for AI chip transfers and impose a temporary ban until the administration submits a national security strategy governing AI exports.

The proposal includes exemptions for “trusted” US companies shipping chips abroad under US control, provided they meet specific security standards.

The legislation comes as the Trump administration prepares to allow Nvidia to sell its H200 chips to China—processors that are significantly more powerful than those previously permitted for export.

Critics argue such sales could undermine US technological advantages, while supporters contend they are necessary to maintain American leadership in AI.

The post Why Nvidia stock’s rally is stuck — and can it break free? appeared first on Invezz