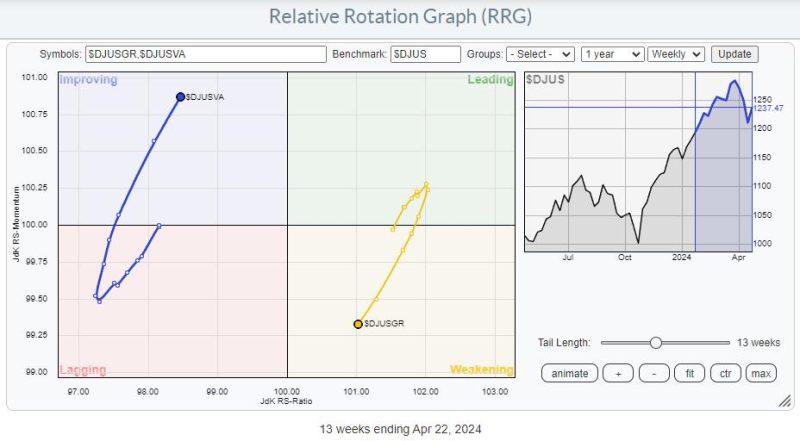

Throughout the past year, the financial market has seen significant shifts. The tide has turned in favor of value stocks, with growth stocks taking a back seat. This shift has raised concerns among investors about the potential downside risks for stocks in the near future.

One of the primary downsides of this transition is the increased volatility it brings to the market. Value stocks, while offering stability and dividends, are often more sensitive to economic fluctuations. This could lead to higher price swings and a bumpier ride for investors.

Another downside risk is the impact of rising interest rates. As the economy recovers and inflation picks up, central banks may decide to raise interest rates to curb inflation. This could dampen stock prices, especially for growth stocks that rely heavily on low-interest rates to fuel their growth.

Furthermore, the growing dominance of value stocks could lead to a lack of diversification in investors’ portfolios. Overexposure to a particular sector or style of investing could leave investors vulnerable to sector-specific risks or market downturns that affect value stocks disproportionately.

The shift towards value stocks also raises concerns about the performance of growth stocks. As investors rotate out of growth stocks and into value stocks, the valuations of growth stocks may come under pressure. This could lead to underperformance for growth stocks in the short to medium term.

Additionally, geopolitical risks continue to pose a threat to the stock market. Uncertainty around trade relations, political tensions, and global conflicts could trigger market sell-offs and volatility, affecting both value and growth stocks.

The rise of environmental, social, and governance (ESG) factors as a critical consideration for investors also presents a downside risk. Companies that do not meet ESG standards may face regulatory challenges, reputational damage, or divestment by socially responsible investors, impacting their stock prices.

Moreover, the ongoing COVID-19 pandemic and the potential emergence of new variants pose a significant downside risk to the stock market. Disruptions to supply chains, lockdown measures, and shifts in consumer behavior could all impact stock prices across sectors.

In conclusion, while the surge of value stocks presents opportunities, it also brings along several downside risks for the stock market. Investors need to remain vigilant, diversify their portfolios, and stay informed about the evolving market dynamics to navigate these risks effectively.