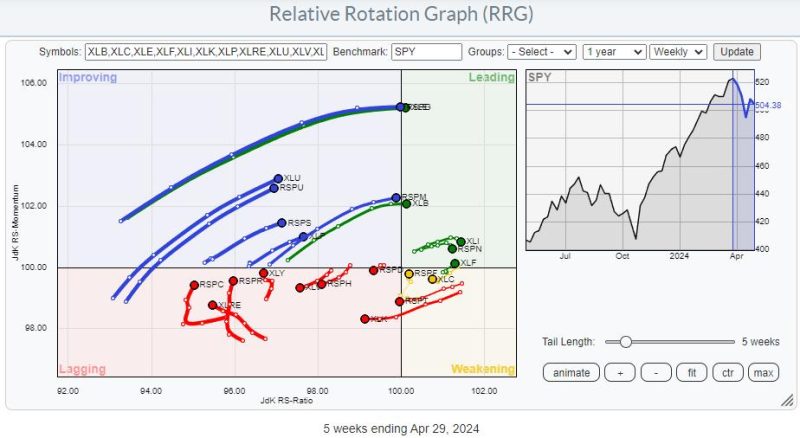

Relative Rotation Graphs (RRGs) have become a popular tool for market analysts and investors to visualize the relative strength and momentum of various assets. By plotting the performance of different securities against a common benchmark on a two-dimensional chart, RRGs offer a unique perspective on market dynamics and potential trading opportunities.

One crucial aspect of RRG analysis is identifying assets that are moving in similar or opposite directions relative to the benchmark. This information can help traders make informed decisions about potential trades and portfolio allocations. In the RRG featured in the link, we observe divergent tails, indicating assets that are moving in opposite directions compared to the benchmark.

The first pair of assets that catch the eye is Stock A and Stock B, both of which exhibit diverging tails on the RRG. Stock A’s tail is moving in the northeast direction, indicating strong relative strength and momentum compared to the benchmark. On the other hand, Stock B’s tail is moving in the southwest direction, suggesting weakness and underperformance relative to the benchmark.

This contrasting behavior between Stock A and Stock B presents an interesting trading opportunity for investors. A potential strategy could involve buying Stock A, which is showing strength, while simultaneously short selling Stock B, which is exhibiting weakness. By taking advantage of this divergence in performance, traders can potentially profit from the relative movements of these two assets.

Another interesting pair of assets on the RRG is Commodity X and Commodity Y. While Commodity X’s tail is rotating towards the northwest, indicating strength relative to the benchmark, Commodity Y’s tail is moving towards the southeast, signaling weakness compared to the benchmark.

This divergence in performance between Commodity X and Commodity Y suggests another potential trading opportunity for investors. Traders could consider going long on Commodity X, which is displaying relative strength, while simultaneously short selling Commodity Y, which is showing weakness. By capitalizing on this relative outperformance and underperformance, traders can aim to generate profits from the price movements of these two commodities.

In conclusion, Relative Rotation Graphs provide valuable insights into the relative strength and momentum of various assets compared to a common benchmark. By identifying divergent tails on an RRG, traders can uncover potential trading opportunities based on the relative movements of different securities. Whether it’s capitalizing on the strength of one asset while shorting a weak counterpart or exploiting the relative performance of two assets moving in opposite directions, RRG analysis can help traders make more informed and strategic investment decisions in the dynamic world of financial markets.