The article discusses the current market conditions and the potential for a market correction. Here is a well-structured and unique article:

Market sentiments are once again on edge as investors brace themselves for what many analysts describe as a toppy market. The term toppy refers to a market that appears to have reached its peak and is showing signs of potential weakness or a forthcoming correction. This notion has been echoed by various experts in recent weeks, triggering concerns among market participants.

Several factors contribute to the growing apprehension about the market’s current state. One key concern is the heightened valuation levels across various asset classes. Stock prices have surged to record highs, with some sectors experiencing significant overvaluations. The rapid ascent of meme stocks and the soaring valuations of tech companies have raised red flags among seasoned investors and analysts.

Furthermore, the Federal Reserve’s monetary policy stance has fueled uncertainty in the market. The central bank’s commitment to maintaining accommodative policies, including near-zero interest rates and ongoing asset purchases, has led to liquidity-driven market rallies. However, the prolonged period of loose monetary policy has prompted fears of asset bubbles and inflated valuations.

Geopolitical tensions and global economic uncertainties also loom over the market, adding to the prevailing sense of unease. Ongoing trade disputes, political instability in various regions, and the lingering impact of the pandemic continue to pose risks to the global economy and financial markets. The resurgence of COVID-19 cases in some countries has reignited fears of disruptive lockdowns and economic downturns.

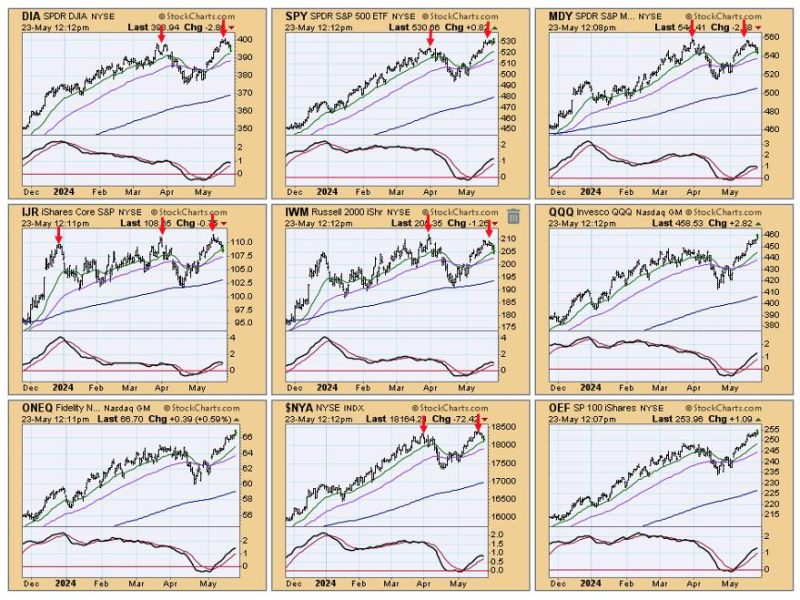

Investors are closely monitoring key indicators that may signal an impending market correction. Technical analysis tools, such as moving averages and relative strength indicators, are being scrutinized for potential signals of market weakness. Market breadth, sentiment surveys, and options market activity are also being closely watched for any signs of a shift in investor sentiment.

While the prospect of a market correction appears increasingly likely, it is essential for investors to exercise caution and adopt a diversified investment approach. Diversification across asset classes, sectors, and geographies can help mitigate risks and protect portfolios from potential downturns. Maintaining a long-term perspective and focusing on fundamentally strong companies with solid growth prospects remains a prudent strategy in times of market uncertainty.

In conclusion, the current market environment presents challenges and risks that investors must navigate carefully. By staying informed, monitoring key indicators, and maintaining a diversified portfolio, investors can position themselves to weather potential market turbulence and capitalize on opportunities that may arise amidst the volatility.