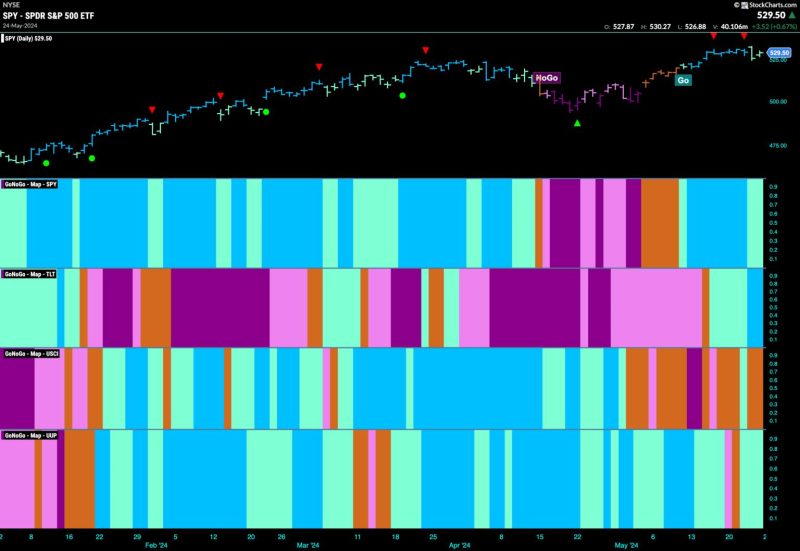

Equities Remain in Go Trend with Sparse Leadership from Tech and Utilities

The equity market continues to show resilience as it remains in a go trend, propelled by sporadic leadership from the technology and utilities sectors. Investors have been closely monitoring the performance of these key sectors, which have played a crucial role in driving market momentum. Despite challenges and uncertainties in the broader market environment, the strength and stability exhibited by these sectors have been instrumental in supporting overall market growth.

Tech companies have been at the forefront of innovation and disruption, driving significant gains in the equity market. The sector’s performance has been buoyed by strong earnings reports, robust product offerings, and ongoing technological advancements. With a focus on emerging trends such as cloud computing, artificial intelligence, and cybersecurity, tech companies have positioned themselves as key drivers of market growth.

Utilities, on the other hand, have provided stability and defensive qualities to investors during times of market volatility. These companies offer essential services that are in demand regardless of economic conditions, making them attractive investment options for risk-averse investors. While not as flashy as the tech sector, utilities have proven to be reliable sources of income and consistent performers in the equity market.

Despite the leadership shown by these sectors, the broader market environment remains uncertain, with geopolitical tensions, trade conflicts, and economic indicators all influencing investor sentiment. While the tech and utilities sectors have provided a degree of stability, investors are advised to maintain a diversified portfolio to mitigate risks and capitalize on opportunities across various sectors.

Looking ahead, continued monitoring of key sectors such as technology and utilities will be crucial in assessing market trends and identifying potential investment opportunities. By staying informed and adapting to changing market conditions, investors can navigate the complexities of the equity market and position themselves for long-term success.

In conclusion, the equity market remains in a go trend, with tech and utilities sectors offering leadership and stability. Investors should stay vigilant, diversify their portfolios, and monitor market trends to make informed investment decisions. By leveraging the strengths of key sectors and adapting to changing market conditions, investors can navigate uncertainties and capitalize on opportunities for growth and prosperity.