In the realm of finance and investing, market breadth serves as a critical indicator that provides insights into the overall health of a market. While the recent pullback has stirred concerns among investors, it is imperative to assess the market breadth to gauge the resilience and potential direction of the market indices. Specifically focusing on the Nifty, the Indian stock market benchmark, understanding its breadth becomes paramount in navigating the intricacies of the market environment.

Market breadth essentially refers to the measure of the number of individual stocks participating in a market move. It indicates whether the movements seen in the market indices are broad-based or if they are being driven by a select few stocks. A market with strong breadth implies that a larger number of stocks are participating in the upward or downward movement, indicating a healthier market condition. On the contrary, weak breadth suggests that only a handful of stocks are influencing the market direction, potentially signaling fragility in the overall market sentiment.

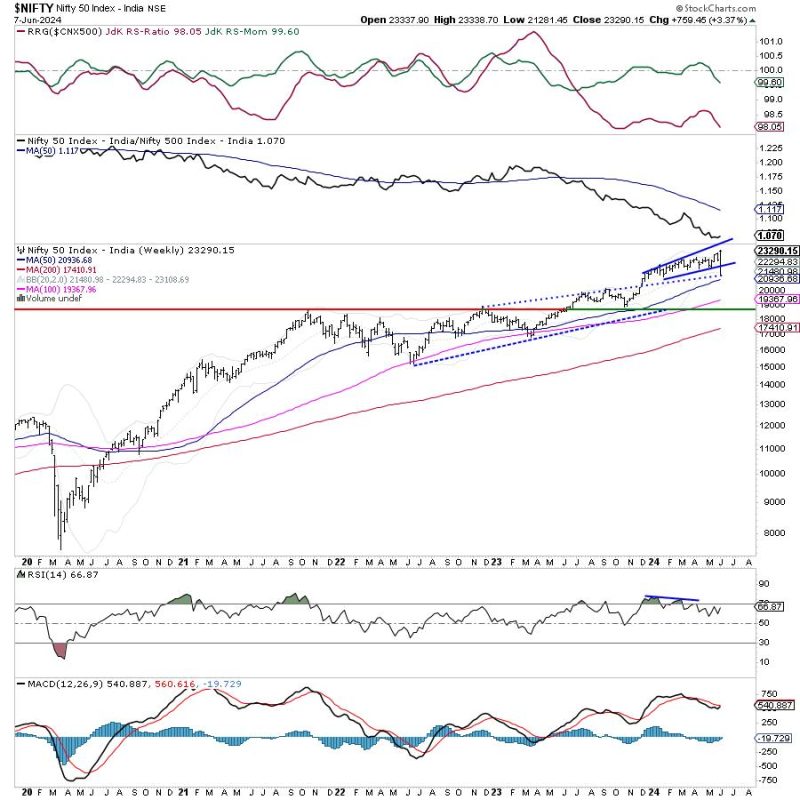

The recent pullback in the Nifty has raised concerns among investors regarding the sustainability of the current market rally. Despite the pullback, it is crucial to note that the market breadth has been a consistent concern. The participation of individual stocks in the upward movement of the Nifty has been relatively limited, with a few heavyweight stocks primarily driving the gains. This lack of broad-based participation raises a red flag and emphasizes the need for cautious optimism moving forward.

Additionally, the Nifty remains prone to retracement, given the current market conditions and global uncertainties. A retracement is a temporary reversal in the direction of a market trend, often triggered by profit-taking or external factors impacting market sentiment. In the case of the Nifty, the pullback experienced recently may be a precursor to a potential retracement, especially if the market breadth does not improve and if external factors contribute to heightened volatility.

Investors and market participants should closely monitor the market breadth indicators to assess the underlying strength of the market. A healthy market breadth, characterized by broad-based participation and a diverse group of stocks contributing to market movements, can instill confidence in the sustainability of market rallies. Conversely, a weak market breadth warrants caution and may suggest a vulnerable market environment susceptible to retracements and increased volatility.

In conclusion, while the recent pullback in the Nifty has sparked concerns among investors, it is essential to delve deeper into market breadth indicators to gain a comprehensive understanding of the market dynamics. By analyzing the breadth of the market and assessing the level of participation among individual stocks, investors can make informed decisions and navigate the evolving market landscape with prudence and foresight. Maintaining a keen focus on market breadth will be crucial in identifying potential risks and opportunities in the ever-changing world of finance and investing.