In the fast-paced world of finance and investing, staying ahead of market trends and understanding investor sentiment is crucial for success. Recent developments on Wall Street have seen stocks taking a defensive posture as the market index enters a period of uncertainty. This shift towards a more defensive strategy has raised eyebrows among investors and analysts alike, prompting a closer look at the factors driving this behavior.

The decision by investors to adopt a defensive stance comes at a time when market volatility is on the rise, fueled by geopolitical tensions, trade uncertainties, and concerns about a slowing global economy. These factors have contributed to a sense of unease among market participants, leading many to seek out safe-haven assets and defensive sectors to protect their portfolios from potential downturns.

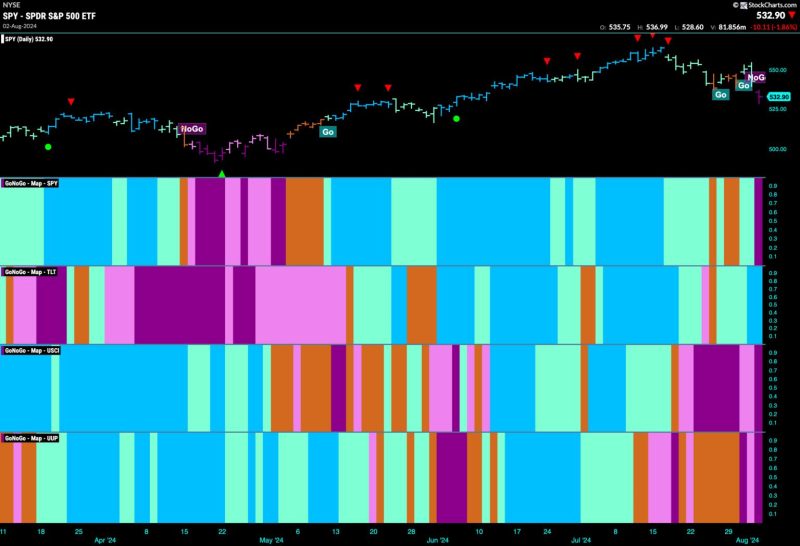

One key indicator of this defensive positioning is the performance of certain sectors relative to the broader market. Defensive sectors such as utilities, consumer staples, and healthcare have outperformed more cyclical sectors like technology and industrials in recent weeks. This divergence in sector performance suggests that investors are gravitating towards companies that offer stability and steady cash flows, rather than those that are more sensitive to economic fluctuations.

Another factor driving the defensive posture of investors is the growing sense of caution surrounding the outlook for corporate earnings. With earnings season in full swing, companies across various sectors have reported mixed results and provided cautious guidance for the coming quarters. This has raised concerns about the sustainability of earnings growth, particularly in the face of rising costs and a potential slowdown in consumer spending.

Additionally, the recent inversion of the yield curve – a closely watched indicator of economic health – has added to the sense of uncertainty in the market. The inversion, where short-term interest rates surpass long-term rates, has historically been a harbinger of economic downturns. While the yield curve is not a foolproof predictor of recession, its inversion has spooked investors and contributed to the defensive positioning seen in the market.

In response to these macroeconomic headwinds, investors have sought refuge in defensive assets such as gold, government bonds, and defensive stocks with strong balance sheets and stable dividends. These assets offer a degree of protection against market downturns and economic uncertainties, serving as a ballast for investor portfolios during turbulent times.

Looking ahead, the defensive posture adopted by investors suggests a cautious and risk-averse approach to navigating the current market environment. While defensive strategies can help shield portfolios from market volatility and economic headwinds, they also come with trade-offs in terms of potential returns and growth opportunities. As investors weigh the risks and rewards of a defensive stance, staying informed and agile in response to changing market dynamics will be key to weathering the storm and capitalizing on opportunities that arise.