The recent news surrounding hedge fund manager Carl Icahn being charged by the Securities and Exchange Commission (SEC) for allegedly hiding billions of dollars worth of stock pledges has sent shockwaves through the financial world. This development brings to light the complexities and potential pitfalls that can arise in high-profile financial dealings.

The allegations put forth by the SEC revolve around Icahn’s apparent failure to disclose to shareholders his intent to pledge shares as collateral for margin loans. This lack of transparency is a critical issue within the financial industry, as it can affect the confidence investors have in the integrity of the market.

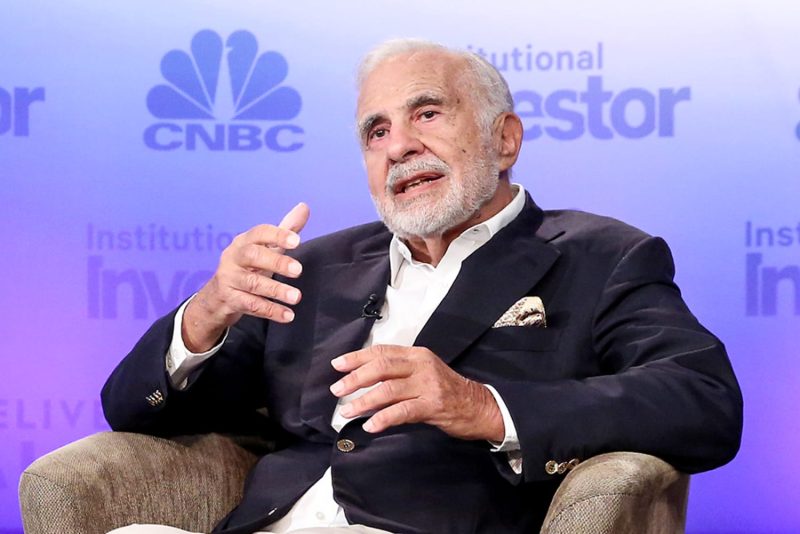

Icahn’s reputation as a prominent figure in the world of finance and his long history of successful investments have made him a prominent and influential figure in the financial community. His ability to move markets with his investment decisions has been well-documented, and his actions are closely monitored by analysts and investors alike.

However, the recent charges against him by the SEC have raised concerns about the potential risks associated with opaque financial dealings. The use of stock pledges as collateral for loans is a common practice in the financial world, but the failure to disclose such transactions can lead to legal and ethical implications.

The case of Carl Icahn serves as a cautionary tale for investors and financial professionals alike. It highlights the importance of transparency and accountability in financial dealings, as well as the potential consequences of failing to adhere to regulatory requirements.

As the case unfolds, it will be interesting to see how it impacts Icahn’s reputation and future investment opportunities. Additionally, it may prompt regulators to reassess existing regulations and guidelines surrounding stock pledges and margin loans to prevent similar incidents from occurring in the future.

In conclusion, the charges against Carl Icahn serve as a stark reminder of the importance of transparency and compliance in the financial industry. As investors and regulators continue to scrutinize the details of this case, it will be crucial to draw lessons from it to strengthen the integrity of the financial markets.