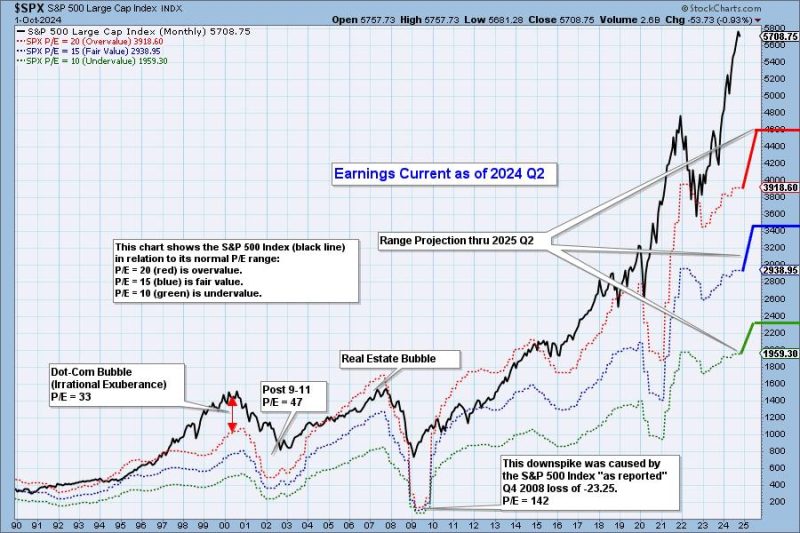

In the ever-evolving landscape of finance and investments, analyzing market conditions and earnings reports is crucial in determining the valuation of assets and the potential for growth. As the second quarter of 2024 comes to a close, market experts have recognized that the market remains highly overvalued, raising concerns among investors and analysts alike.

One of the key factors contributing to the current overvaluation of the market is the disconnect between corporate earnings and stock prices. While company earnings have shown signs of growth, stock prices have soared beyond what can be justified by these earnings. This disparity has led to inflated valuations and increased market volatility, posing risks for investors who may be exposed to sudden market corrections.

Despite the strong financial performance of many companies during the second quarter of 2024, there are underlying concerns about the sustainability of this growth. Economic indicators such as rising inflation, supply chain disruptions, and geopolitical tensions have created uncertainties that could impact corporate earnings in the coming quarters. As a result, investors are advised to exercise caution and conduct thorough due diligence before making investment decisions in such a volatile market environment.

Furthermore, the role of central banks in shaping market dynamics cannot be overlooked. The Federal Reserve and other central banks around the world have played a crucial role in supporting asset prices through accommodative monetary policies. However, as economies recover and inflationary pressures build up, central banks may be forced to tighten monetary policy, potentially leading to a downturn in asset prices and a revaluation of market multiples.

In light of these factors, investors are encouraged to adopt a balanced approach to their investment strategies. Diversification across asset classes and sectors can help mitigate risks associated with market fluctuations and ensure a more stable portfolio performance. Additionally, keeping a close eye on macroeconomic indicators, corporate earnings reports, and central bank policies can provide valuable insights that guide investment decisions in a rapidly changing market landscape.

As the market continues to grapple with overvaluation concerns, it is essential for investors to remain vigilant and proactive in managing their investment portfolios. By staying informed, diversifying their holdings, and staying attuned to market developments, investors can navigate the challenges of an overvalued market and position themselves for long-term success in the world of finance and investments.