In the world of trading and investments, making sense of market fluctuations is essential for success. This involves understanding key levels and markers that can guide decision-making. In the week ahead, as the Nifty consolidates, it is crucial to keep an eye on specific levels that can offer valuable insights to traders and investors.

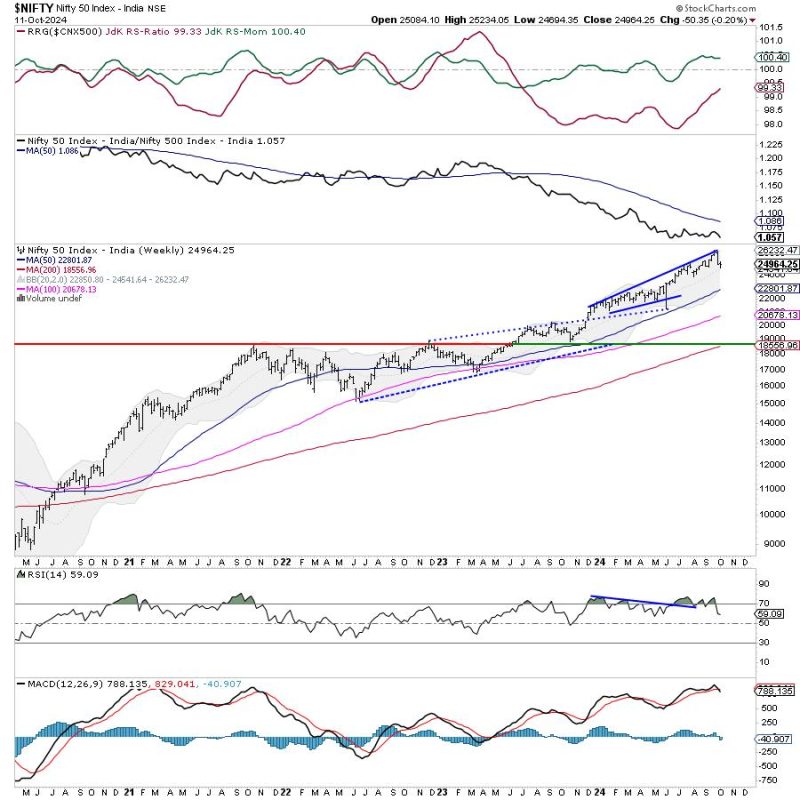

One of the key levels to watch is the immediate support level. By closely monitoring how the Nifty behaves around this level, market participants can gauge the strength of the current consolidation phase. A timely breakdown below this support level could signal a potential shift in market sentiment, prompting traders to adjust their strategies accordingly.

Conversely, the resistance level serves as a crucial point of reference for assessing the upside potential of the Nifty. A decisive breach above this level could indicate a breakout from the consolidation phase, opening up new opportunities for bullish trades. Traders are advised to pay close attention to price action near this resistance level for potential signals of market direction.

Another important aspect to consider is the overall market trend. Identifying the prevailing trend can provide valuable context for interpreting price movements and making informed trading decisions. Traders should keep in mind the broader market dynamics and how they align with the current consolidation phase in order to navigate the market effectively.

In addition to technical levels, external factors such as economic indicators, geopolitical events, and policy announcements can also impact market sentiment. Staying informed about these developments and their potential implications on the Nifty can help traders anticipate market movements and adjust their strategies accordingly.

Overall, while the Nifty consolidates in the week ahead, traders and investors should focus on keeping a close watch on key levels, assessing market trends, and staying informed about external factors that could influence market dynamics. By adopting a disciplined and proactive approach to monitoring these factors, market participants can navigate the markets with confidence and make informed decisions that align with their trading objectives.