**Technical Analysis: Nifty May Stay Ranged, Trending Moves to Occur if Key Edges are Breached**

**Support Levels**

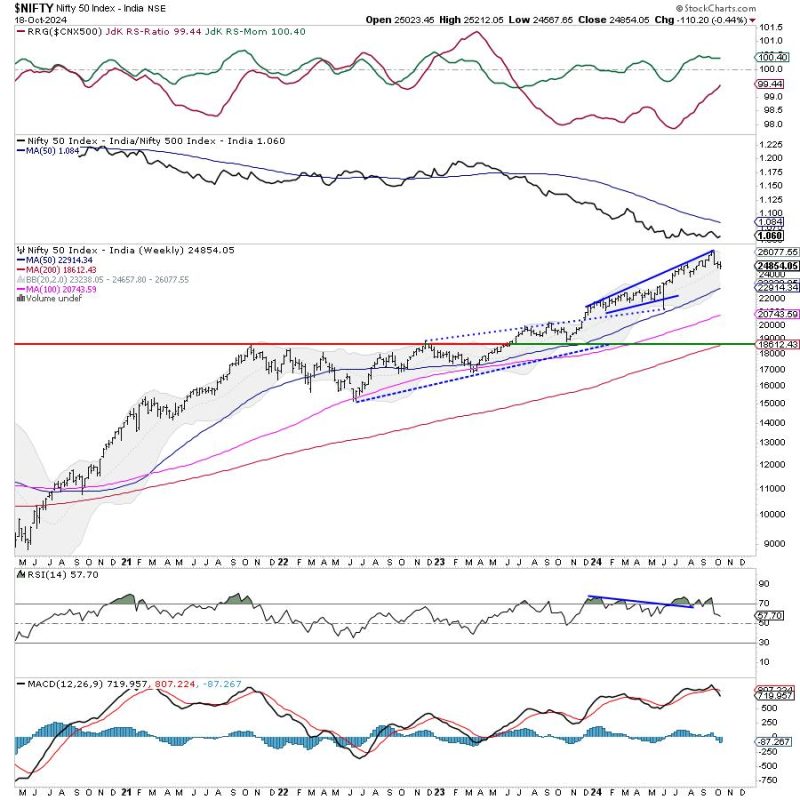

– The Nifty index is expected to maintain a range-bound movement in the upcoming week, with support levels at 14,300 and 14,100. These levels act as strong foundations for the market, preventing significant downward movements.

– Traders and investors can monitor price action near these support levels to assess market sentiment. A bounce from these levels might indicate bullish momentum, whereas a breakdown could signal potential weakness.

– The 50-day moving average, currently around 14,120, also serves as a crucial support level, determining the short-to-medium-term trend of the market. Observing how the index reacts around this moving average can provide valuable insights for trading decisions.

**Resistance Levels**

– On the upside, resistance levels for the Nifty are identified at 14,600 and 14,800. These levels represent significant barriers that the index must overcome to establish a new upward trend.

– Crossing above the resistance at 14,600 could pave the way for further upside movement, potentially signaling a shift towards a more positive market sentiment. Traders can watch for decisive breakouts above this level for confirmation of a bullish trend.

– The 14,800 level acts as a critical psychological barrier for the market. A breach of this resistance would likely attract more buyers, triggering a strong uptrend. Investors should closely monitor price action near this level for potential trend reversal signals.

**Key Indicators**

– Traders can utilize technical indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) to gauge the momentum and strength of price movements in the Nifty index.

– The RSI is currently hovering around the neutral zone, indicating a balanced market sentiment. A move above 60 could signal increasing buying pressure, while a drop below 40 might suggest a shift towards bearish sentiment.

– The MACD line is approaching the signal line, hinting at a possible trend reversal in the near future. Traders should closely monitor the MACD crossover for potential entry or exit points in the market.

**Market Outlook**

– Overall, the Nifty index is poised to consolidate within a range in the upcoming week, with potential trending moves contingent on breaching key support and resistance levels.

– Traders should remain vigilant and adapt their strategies based on price action around these significant edges. By staying informed and analyzing technical indicators, market participants can make informed decisions to navigate the evolving market landscape effectively.