The article discusses the outlook for the Nifty in the upcoming week and highlights the possibility of a stable start while facing selling pressure at higher levels. The increased volatility in global markets, particularly due to the ongoing U.S.-China trade tensions, has impacted investor sentiment. Additionally, the uncertainty surrounding Brexit negotiations and the upcoming Federal Reserve meeting also contribute to the apprehension among traders.

Experts suggest that investors need to carefully monitor key levels on the Nifty chart, such as 10,950 and 10,800, as these levels will play a crucial role in determining market direction. Resistance at 10,950 poses a challenging barrier for the Nifty, making it essential for traders to exercise caution and closely observe market movements in the upcoming week.

Technical indicators indicate a cautious stance, hinting at the likelihood of the Nifty facing volatile swings during the week. Market participants are advised to maintain a diversified investment portfolio and consider hedging strategies to mitigate risks associated with potential market fluctuations.

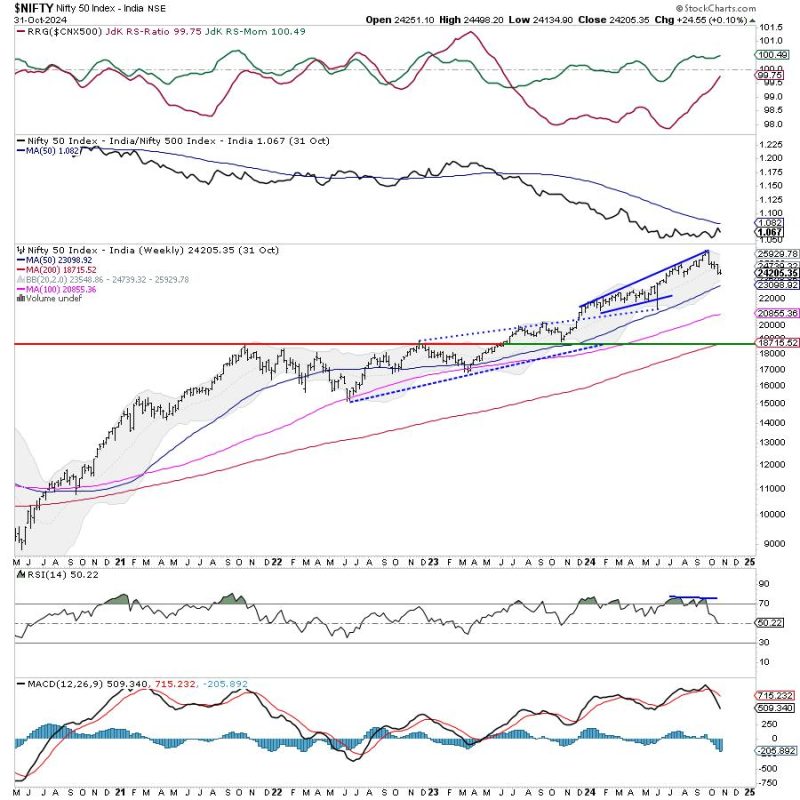

Analysts point out that the Nifty may experience profit-taking at higher levels, leading to a consolidation phase. However, the long-term trend remains positive, with the Nifty continuing to trade above its crucial moving averages, indicating overall market strength. Therefore, investors are encouraged to adopt a long-term perspective and focus on fundamentally strong stocks for sustained growth.

In conclusion, while the Nifty may see a stable start in the upcoming week, it is crucial for investors to remain vigilant amidst the prevailing volatile market conditions. By closely monitoring key levels and employing prudent investment strategies, market participants can navigate the uncertainties and position themselves for long-term growth and success in the stock market.