In the fast-paced world of financial markets, investors are constantly analyzing various signals to make informed decisions about their trades. Recently, a short-term bearish signal has emerged as markets prepare for a news-heavy week. This signal suggests potential downside risk and uncertainty in the near future.

One of the key factors contributing to this bearish signal is the upcoming influx of market-moving news events. Financial markets are highly sensitive to developments such as economic indicators, central bank announcements, trade policy updates, and geopolitical tensions. As a result, the prospect of multiple significant news releases within a short time frame can create volatility and uncertainty, leading to a bearish sentiment among investors.

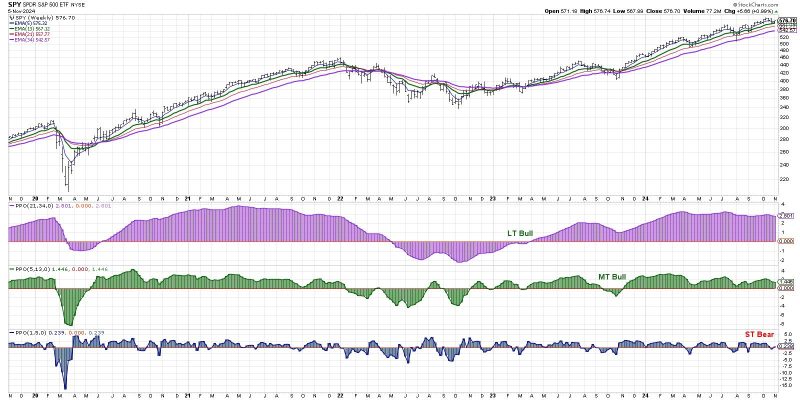

Furthermore, technical indicators are also pointing towards a potential downturn in the market. For instance, moving averages, which are widely used by traders to assess the direction of trends, have shown patterns indicating a weakening market sentiment. Additionally, various momentum and volatility indicators are signaling increased caution among market participants, hinting at the likelihood of a bearish trend in the short term.

The bearish signal is further supported by the prevailing macroeconomic environment. Factors such as inflationary pressures, supply chain disruptions, and uncertainty surrounding interest rate hikes have added to the overall market unease. These broader economic conditions can influence investor sentiment and contribute to a risk-off attitude, prompting a pullback in asset prices.

Amidst this bearish outlook, risk management becomes crucial for investors looking to navigate the uncertain market conditions. Establishing proper stop-loss levels, diversifying portfolios, and staying informed about market developments are essential strategies to mitigate potential losses and make informed trading decisions in volatile market environments.

While the short-term bearish signal may raise concerns among investors, it is crucial to approach the situation with a rational and informed mindset. By understanding the various factors contributing to the bearish sentiment and implementing sound risk management practices, investors can position themselves to weather market volatility and capitalize on opportunities that may arise in the midst of uncertainty.