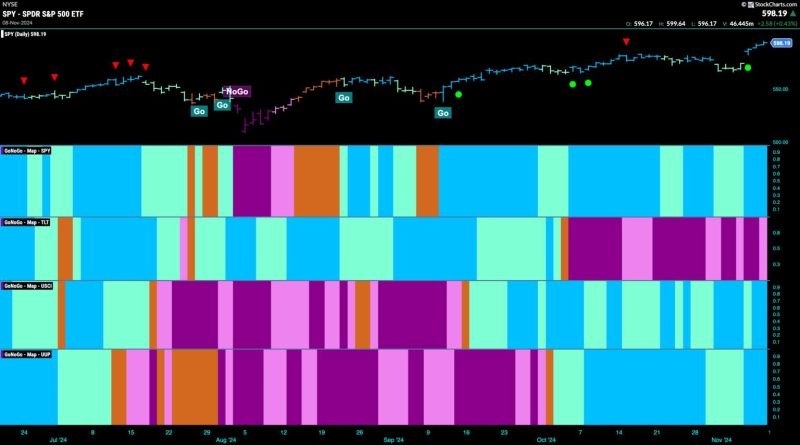

Equity-Go Trend Sees Surge in Strength as Financials Drive Price Higher

According to recent market trends, the Equity-Go strategy is experiencing a surge in strength driven primarily by the financial sector. This strategy, which focuses on equity investments, particularly in growing and profitable companies, has gained momentum in recent months as savvy investors seek to capitalize on the bullish run.

One of the key factors contributing to the heightened interest in the Equity-Go trend is the strong performance of financial companies. As the economy continues to recover from the impacts of the global pandemic, financial institutions are reporting robust earnings growth and improving operating metrics. This positive outlook for the financial sector has translated into increased investor confidence and a rise in stock prices for many financial companies.

In addition to the strong performance of financials, the Equity-Go trend is also benefiting from a broader market rally. As global economies rebound and uncertainty around the pandemic subsides, investor sentiment has become increasingly optimistic. This favorable market environment has created a tailwind for companies across various sectors, propelling stock prices higher and fueling the Equity-Go strategy.

Moreover, the Equity-Go trend is well-suited to capitalize on the current market dynamics. By focusing on high-quality businesses with strong growth potential, this strategy allows investors to participate in the upside potential of the market while mitigating risks associated with volatile or speculative investments. As such, the Equity-Go approach offers a balanced and prudent investment strategy, appealing to both risk-averse and growth-oriented investors.

Furthermore, the rise of innovative technologies and digital transformation has provided a new impetus for the Equity-Go trend. Companies leveraging technology to optimize their operations and enhance their competitive advantage are attracting investor attention due to their ability to drive growth and deliver long-term value. As a result, technology-focused firms are becoming an increasingly important component of the Equity-Go strategy, further diversifying and strengthening its investment potential.

In conclusion, the Equity-Go trend is experiencing a surge in strength propelled by the impressive performance of financials, a favorable market environment, and the growing relevance of technology-driven companies. With its focus on high-quality investments and prudent risk management, the Equity-Go strategy offers investors a compelling opportunity to benefit from the current market dynamics while navigating potential challenges. As investors continue to seek out strategies that can deliver sustainable returns in a rapidly changing market landscape, the Equity-Go trend stands out as a promising and resilient option for those looking to grow their wealth over the long term.