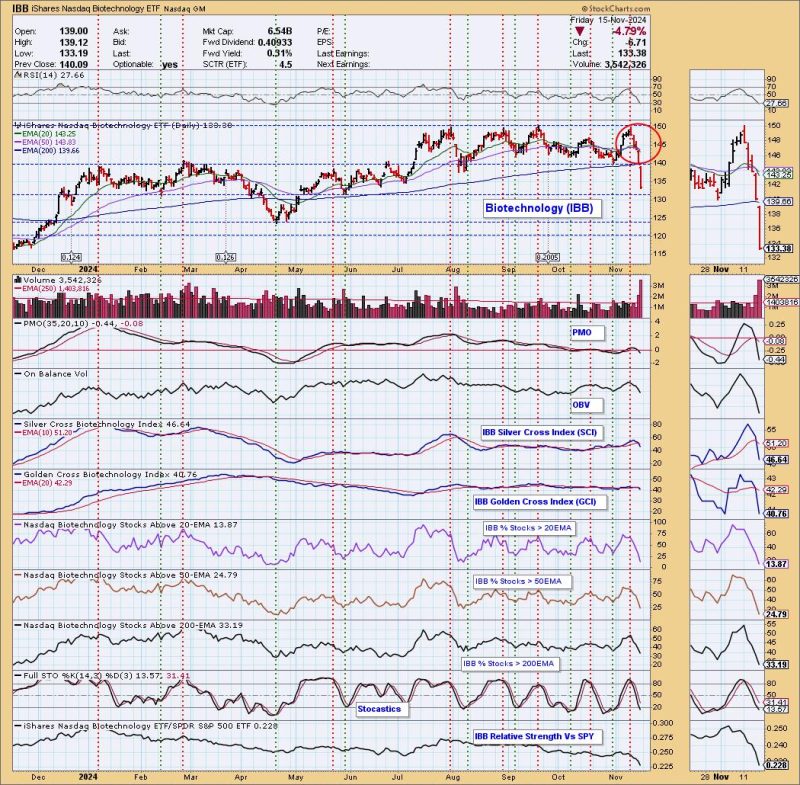

Biotechs Fall Apart with Dark Cross Neutral Signal

The biotech sector has been experiencing a downturn recently, with many companies facing challenges that have resulted in a dark cross neutral signal being observed in their stock performance. This signal, which occurs when a stock’s short-term moving average crosses below its long-term moving average, is often seen as a bearish indicator for the stock’s future performance.

One of the key factors contributing to the biotechs’ struggles is the increasing competition within the industry. As more companies enter the market with similar products and technologies, established biotech firms are finding it harder to maintain their market share and profitability. This heightened competition has led to pricing pressures and diminishing margins for many biotech companies, putting a strain on their financial health.

In addition to competition, regulatory challenges have also posed a significant hurdle for biotechs. The FDA approval process for new drugs and therapies can be lengthy and expensive, requiring companies to invest substantial resources in research and development before they can bring a product to market. Delays in the regulatory approval process can significantly impact a biotech company’s revenue projections and stock performance, leading to investor uncertainty and potential share price declines.

Another contributing factor to the biotechs’ struggles is the broader market sentiment towards riskier assets. With increasing volatility in the stock market and concerns about a potential economic slowdown, investors have become more risk-averse and are shying away from high-growth sectors like biotech. This risk-off sentiment has put additional pressure on biotech stocks, leading to a decline in valuations and a loss of investor confidence.

Looking ahead, biotech companies will need to navigate these challenges and adapt to the changing market environment in order to regain investor trust and drive future growth. This may require a renewed focus on innovation, cost efficiency, and strategic partnerships to differentiate themselves from competitors and capture new market opportunities.

In conclusion, the dark cross neutral signal observed in the biotech sector reflects the current challenges facing these companies, including increased competition, regulatory hurdles, and changing investor sentiment. By addressing these challenges head-on and taking proactive measures to improve their operational and financial performance, biotechs can position themselves for long-term success in an increasingly competitive and dynamic market landscape.