Nvidia is moving aggressively to expand its manufacturing footprint in the United States.

The company announced plans on Monday to build as much as $500 billion worth of AI infrastructure in the country over the next four years through a network of manufacturing partnerships.

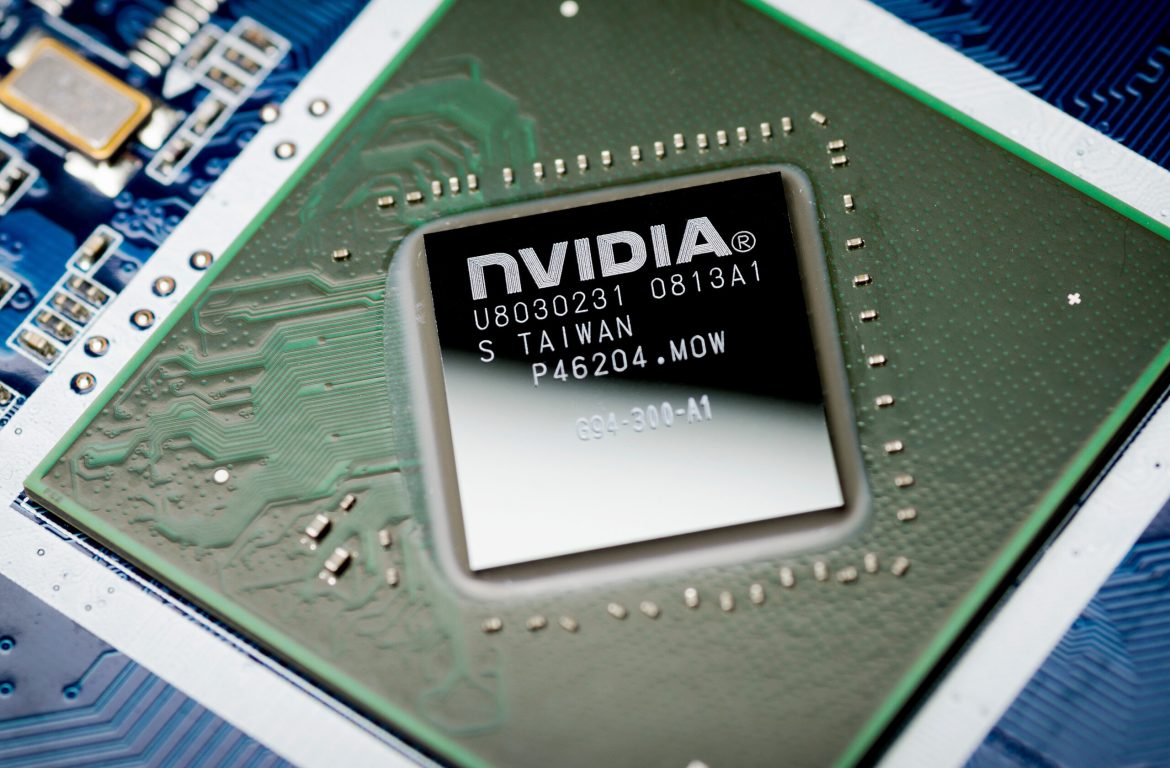

The initiative, designed to address soaring global demand for AI chips and mitigate supply chain risks, will see production of Nvidia’s latest Blackwell AI chip begin at Taiwan Semiconductor Manufacturing Co.’s new plant in Phoenix.

Additionally, Nvidia is establishing supercomputer manufacturing facilities in Texas in collaboration with Foxconn and Wistron Corp.

For downstream operations like packaging and testing, the company is partnering with Amkor Technology Inc. and Siliconware Precision Industries Co. in Arizona.

Nvidia said mass production is slated to ramp up within 12 to 15 months, marking the first time AI supercomputers will be manufactured in the US — a milestone President Donald Trump highlighted in a Truth Social post Monday as evidence of his administration’s industrial policy gains.

“Adding American manufacturing helps us better meet the incredible and growing demand for AI chips and supercomputers, strengthens our supply chain and boosts our resiliency,” Nvidia CEO Jensen Huang said in the statement.

Nvidia shares rallied as much as 3% to $114.29 in New York in early trading on Monday.

At the time of writing, the stock is down over 1.5%.

The stock remains down 20% for the year, as tech shares continue to face intense selling pressure amid market volatility and policy-driven headwinds.

Trump tariff overhang still looms

The announcement comes at a pivotal moment for the tech and semiconductor industries, which have been caught in the crosshairs of President Trump’s evolving tariff strategy.

Although the administration issued a temporary exemption for smartphones, computers, and other popular electronics from its latest tariff round,

Trump has since downplayed the move as procedural and reiterated his intention to impose levies on those categories.

Major corporations across industries — from Apple to Eli Lilly — have announced multibillion-dollar US manufacturing plans since Trump’s election.

Many of these investments either predate his presidency or follow established capital expenditure trends, but the political messaging around them has intensified amid the current trade policy reset.

Nvidia’s manufacturing push appears aimed at positioning itself defensively within this environment, shoring up supply chains while aligning itself with Washington’s reshoring narrative — a move likely to resonate both commercially and politically.

Last week, analysts at Citi trimmed their price target on Nvidia to $150 from $163, flagging expectations of a deceleration in GPU sales.

The investment firm, however, kept a Buy rating on the stock.

Even with the lowered target, the revised estimate still suggests a potential 39% upside from current levels.

The post Nvidia unveils plans for US-made AI supercomputers amid $500B buildout appeared first on Invezz