The ATR Trailing Stop: A Powerful Tool for Trade Management and Trend Definition

Understanding how to effectively manage trades and define trends is crucial for successful trading in the financial markets. One powerful tool that experienced traders often utilize for these purposes is the Average True Range (ATR) Trailing Stop. By incorporating the ATR Trailing Stop into their trading strategy, traders can better manage risk, stay in profitable trades longer, and accurately determine the prevailing market trend.

The ATR Trailing Stop is based on the Average True Range indicator, which measures market volatility by calculating the average range between the high and low prices over a specified period. The ATR can help traders gauge the level of price movement in a given market, providing valuable insights into potential price fluctuations.

When it comes to managing trades, the ATR Trailing Stop is particularly useful for setting dynamic stop-loss levels. Unlike fixed stop-loss orders, which remain static regardless of market conditions, the ATR Trailing Stop adjusts according to market volatility. This means that the distance between the trailing stop and the current price will vary based on the ATR value, allowing traders to give their trades enough room to breathe without being too exposed to significant losses.

By trailing the stop-loss order behind the current price at a distance determined by the ATR value, traders can capture more profits during strong trends while protecting their capital during periods of increased volatility. This dynamic approach to risk management can help traders maximize their gains and minimize their losses, leading to a more consistent and profitable trading performance.

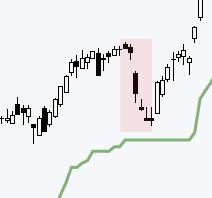

In addition to trade management, the ATR Trailing Stop can also be used to define the trend in a given market. By observing the relationship between the price and the ATR Trailing Stop level, traders can identify whether the market is trending up, down, or moving sideways.

When the price is consistently trading above the ATR Trailing Stop, it indicates a bullish trend, suggesting that traders should look for opportunities to enter long positions. Conversely, when the price consistently falls below the ATR Trailing Stop, it signals a bearish trend, prompting traders to consider short-selling opportunities.

On the other hand, if the price moves back and forth around the ATR Trailing Stop without any clear direction, it suggests that the market is ranging or consolidating. In such cases, traders may choose to avoid taking new positions until a clear trend emerges.

In conclusion, the ATR Trailing Stop is a versatile tool that can greatly enhance a trader’s ability to manage trades effectively and identify market trends accurately. By incorporating this indicator into their trading strategy, traders can improve their risk management practices, stay in winning trades longer, and make informed decisions based on the prevailing market conditions. Whether you are a beginner or an experienced trader, mastering the ATR Trailing Stop can significantly boost your trading performance and help you achieve your financial goals in the markets.